(Warning to readers: today’s blog is a long read about student aid policy. Skip it if this kind of wonkery isn’t to your taste.)

Last week’s historic changes to the Canada Student Loans Program – which saw the elimination of the Education and Textbook Tax Credits, and an increase of 50% in Canada Student Grants – is a very complicated piece of policy to analyze. Remember that there is no new money in this set-up: any new money given to one set of students through grants is money taken away from another set of students in tax credits. So it’s reasonable to ask the question: “who won and who lost?” because governments sure as heck aren’t eager to spell this stuff out.

If you want to refresh yourself on the details of the tax credit/grant switcheroo, go back to our budget analysis document and read pages 2-6. Got it? Good. Then we’ll begin.

Winners and losers get divided up along three axes: by geography, by “family” income, and by full-time/part-time status. We’ll start with geography, and move down from there.

Quebec: Every single full-time student in Quebec loses $558 from the disappearance of the tax credits. What they will get back is uncertain. The Canada Student Grants program does not operate in Quebec, so no one will “win” by getting money from that source. Instead, the government of Quebec will receive something in the region of $500 million from the government of Canada over the next four years in “alternative payments” (that’s a rise of about 40% on what the province currently gets). Will the government invest all that money in student aid? We don’t know because the government is being non-committal at the moment. If it does, how will it do so? Again, no clue. So we have literally no idea who the winners and losers will be in Quebec.

The Rest of Canada, Bar Ontario: Again, every single FT student will lose $558 in tax credits. If they are considered “low-income” (I’ll come back to this), they will – once the changes are fully phased-in for 2017 – get an extra $1,000 in grants and thus be “up” on the deal by $442. If they are not at all eligible for grants, they will be “down” $558. What happens to the students in between – the so-called “middle-income students” – is a little unclear.

First, who are “middle-income students”? The definition varies by province and family size (see Tables 10A and 10B here), but if you’re a dependent student from a family of four, it means (roughly) those from families earning between $45,000 and $85,000; if you’re a single independent student, it means those earning between $23,000 and $43,000 (most independent students are low-income and eligible for maximum grants, but not all of them take advantage of the program).

Now, if all you look at is the 2016-17 changes to Canada Student Grants (+$400), and you subtract the $558 in missing credits, you might think “holy cow, these middle-income students are out $158!” Which, to be honest, I did briefly on budget night. But the program changes aren’t ending in 2016-17. In 2017-18, CSLP wants to stop giving out these grants as a step function, and smooth the curve, roughly like so:

Figure 1: CSG Value by Income Level, 2015-16 vs. 2017-18

(Caveats on graph: that’s for a family of four in Ontario; mileage may vary by province and family size, and we don’t know exactly what the smoothing formula will look like.)

This is a very different kind of picture. Those just above the low-income/middle-income cut-off become massive winners – their annual grant amount will increase by almost $2,200. However, at the other end of the spectrum, those just below the middle-income cut off – say, families making about $80K – will see changes of less than $558, and so need to be counted among the “worse-off”.

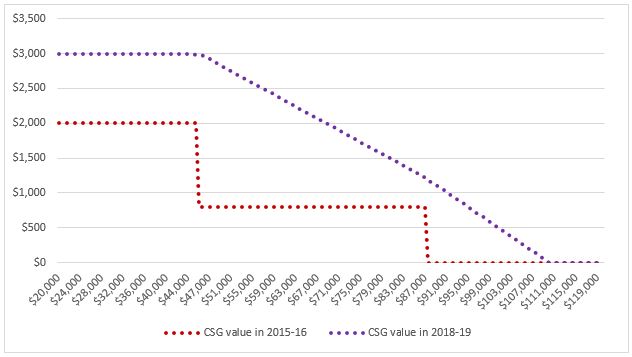

But this still isn’t the final story, because there’s another CSG change scheduled for 2018-19, which will involve extending the middle-income cut out-off somewhat (my understanding is that for our hypothetical family it will be slightly north of $100,000/yr). That won’t help the people just below $80k, but it will make “winners” out of a number of people in the $80-100K range.

Figure 2: CSG by Income Level, 2015-16, 2017-2018, 2018-19

(Caveats on this graph are same as previous, only this time we have even less idea what the exact formula will look like. Think of it as an artist’s rendering of a bunch of vague statements in the Budget and the Liberal Manifesto.)

Based on this, what we can probably say is that all independent students will end up as net beneficiaries (if they bother to apply for aid), as will all dependent students coming from families with incomes below $100K (bar a few with incomes in the $75-80K range). Above that line, there will be losers to the tune of $558/year.

Ontario: The situation in Ontario is a little more complex because in addition to the CSL changes there are the similar changes to the provincial program announced in the February provincial budget. Because the province is killing both its own education amount tax credit and its own tuition tax credit, every student (and/or their family) is losing $1,176 in combined tax relief.

Now, who actually wins and loses is difficult to tell at the moment because we really have no idea what the provincial formula will look like. Based on a tiny sliver of information contained in charts 1.16 and 1.17 of the Ontario Budget, my understanding is that dependent students from families making under about $80,000 are net winners – in some cases by a thousand dollars, or even a bit more. Above $110,000 it’s all net losers – students from families above this level will keep the grants they currently have but lose all their tax credits. In between, the best guess is that all will be net losers; however, the exact amount of the loss will depend on the nature of the CSLP 2018-19 changes.

That’s dependent students – what about independent ones? Here, it’s *very* difficult to tell. Unlike the federal grants, current Ontario grants are restricted to dependent students, and the language in last month’s Budget is ambiguous as to whether independent students will have access to the new grants. I think it’s telling that none of the examples given in this Ontario budget backgrounder are independent students; this implies that the province simply hasn’t yet figured out what the rules for these students will be. So for the moment we simply show how the winners and losers will break out among independent students.

(Nota bene: if you’re wondering why the Ontario change seems to have a worse winners-to-losers ratio than the federal one, it’s because money in the system is not conserved. If you read the text of the budget carefully, you’ll note that some of the money from the eliminated tax credits is going to universities and colleges – students themselves will, on aggregate, receive less money in total after the change than before. Less money = fewer winners.)

Part-Time Students: You’ll notice that I’ve been focusing on full-time students: that’s because the calculus is quite different for the country’s half-million or so part-time students. Part-timers receive a smaller amount of education and textbook credits: only $168 federally. They all lose this amount; part-timers in Ontario will also lose an additional $100-200 or so depending on how much tuition they are paying. The federal system makes up for this in a tiny, tiny way by increasing bursaries for part-time students – something which currently only about 13,000 students receive. The Ontario system does not give money to part-time students at all. So for this demographic, it seems that nearly everyone loses from the re-shuffle.

So, what do we conclude from all this? Two things:

1) Part-time students everywhere, and (possibly) mature students in Ontario, don’t do very well out of these changes.

2) In the main, among dependent students at least, there will be a growing gap in net prices by family income. In Ontario, families with below median incomes will see their net tuition fall by $1,000 or so; those with incomes in the top quartile will see an increase of nearly $1,200. Basically, tuition is becoming a much more progressive user fee. And that’s altogether to the good.

Tweet this post

Tweet this post