Every few weeks, it seems, someone shows up on twitter just aching to serve me some dubious justification for free tuition. Let me recount two recent favourites.

The first is the “oh but progressive taxation argument”. It goes like this:

Me: “You know universal subsidies for higher education are regressive, right? On account of how the take-up rate for higher education – the likelihood of attending, the length of attendance, etc. – is positively correlated with family socio-economic status”? (check back to one of last week’s blogs to see the data for free tuition Denmark if you don’t believe me)

Free Tuition Person: “It’s not regressive if you reform the tax system to make it more progressive at the same time.”

Now, you must think about this sentence for a second. Leave aside the fact that income tax in Canada is already relatively progressive (the top 1% of income earners pay 17.9% of all income taxes paid, the top 20% pay 64.4% of all income taxes, and 55.9% of total taxes) – no doubt one could make it more so by various contrivances if we wanted to. But the point is: under no possible circumstance does changing the tax system make free tuition more progressive. If progressivity is what you care about, a change to the tax system will always be a better move than a change to the tax system plus free tuition. When you hear someone say, “free tuition, combined with changes to the tax system makes for a more progressive system”, it’s functionally equivalent to those cereal commercials which say that Chocolate Frosted Sugar Bombs are “part of” a balanced, nutritious breakfast.

My other recent favourite is actually a couplet: “but universal programs build social cohesion” and “universal social programs are hard to dismantle”. The first one is a basically non-testable proposition, but it sounds good and obviously if you oppose social cohesion you must be some kind of monster (I actually think it’s both absurdly statist and profoundly depressing to think that the depth of a society’s mutual obligations might actually be measured based on the number and sizes of cheques people receive from government, but perhaps this is old-fashioned of me).

But the second one…well, the second one sounds good but it’s simply not true. And the best place to look for evidence is in Canada’s transfer programs for children. Back in World War II, we had something called a “baby bonus” (technically, the “Family Allowance”) – a universal flat payment per child from Ottawa to parents. You may have noticed that this no longer exists. That’s because it’s not in fact that difficult to dismantle universal social programs. It was replaced by a more targeted set of benefits in 1989 (later modified in 1992 and then 1997 to become the Canada Child Tax Benefit (CCTB) and the National Child Benefit (NCB)). There was very little resistance to this.

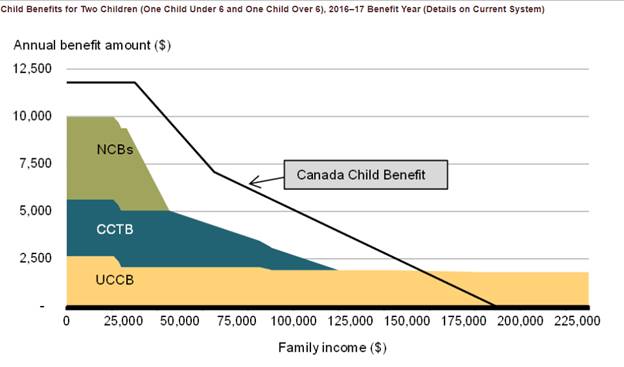

Then in 2006 the Harper government partially revived universal benefits when it created the Universal Child Care Benefit (UCCB) – a flat, taxable $100/month to all parents under six. If you didn’t see progressive rolling out the red carpet for this incredibly wonderful piece of social-cohesion-building that’s because Harper introduced it as an alternative to the Liberal proposal to pay for more daycare spots (in the world of the Canadian left, the hierarchy of goodness is Goods Provided by Public Sectors Workers > Universal Benefits > Targeted Benefits). And yet, again, this universal benefit was dismantled with ease a decade later when the present government came to power and combined the universal UCCB, and the targeted NCB, and the CCTB, added about $5-6 billion in new spending and came up with a new targeted benefit called the Canada Child Benefit. If you want the details of how these got merged, check out this excellent document from the Parliamentary Budget Office, or check out the before/after benefits by income level in the figure below.

Now, I mention this not just because literally no one on the left preferred the UCCB to the new CCB (which makes you wonder why they apply different standards to transfers for post-secondary education), but because of another news story which came out a few weeks ago: namely , that (mainly) as a result of the introduction of the targeted CCB, the number of children living in poverty fell by a third between 2015 and 2017. And that was for a net investment of $5 billion or so.

If we take the universal-benefits-are-the-bomb people at their words, this investment should be considered totally illegitimate. Social cohesion could not possibly be maintained unless every parent in the country was getting $12,000 per year, just like those making under $30K/year do now. Not one extra person would be taken out of poverty as a result (because over $30K is well above the poverty line), but hey, social cohesion. The fact that it might cost upwards of another $30 billion or so? Irrelevant! Social Cohesion! No price is too high!

I am, of course, caricaturing the position of the universal benefits types. Nobody is suggesting spending another $30 billion on the CCB. Because what would be the point? It is to laugh.

The question is, though: why do the universal benefits types apply such a different logic when it comes to tuition and student aid?

The original version of this post had inaccurate tax numbers, which we have corrected. Thank you to our readers for noting this error.

Tweet this post

Tweet this post

I was hoping you had given up making up straw man opponents to knock down on this issue. We have no idea who you are responding to or what they really said. Given the large number of jurisdictions offering free tuition, there are no doubt better arguments for it than the non-starters you offer here.

The link referencing the income tax in Canada is to a US site for US taxes. I was expecting this to be Canadian data.

Yeah, that was a result of writing a post too late at night and not paying attention. Apologies.

The equivalent Canadian data (which iss what I meant to cite) is: Top 1% of earners pays 17.9% of all income taxes (and 14.7% of total taxes), top 20% pay 64.4% of all income taxes (and 55.9% of total taxes). Source: https://www.fraserinstitute.org/sites/default/files/measuring-the-distribution-of-taxes-in-canada.pdf

Again, my bad. Thanks for pointing this out.