The Ontario NDP have started down the road to madness on student aid. Someone needs to stop them.

Here’s the issue: the NDP have decided to promise to make all Ontario student loans interest-free. As a policy, this is pretty meh. It’s not the kind of policy that increases participation because students don’t really pay attention to loan interest, and it’s not going to make loans a whole lot more affordable because Ontario forgives most loans anyway (as a consequence something like 90% of all loans in repayment in Ontario are federal loans which wouldn’t be subject to this policy). My back-of-the-envelope calculation is that this policy might save a typical borrower in repayment something like $5/month, which isn’t a big deal as far as affordability is concerned. One could argue that affordability of loan repayments shouldn’t be a big priority since loan payments as a fraction of average graduate income has gone down by about a third in the past fifteen years, but on the other hand, this isn’t likely to cost very much either, so really, who cares?

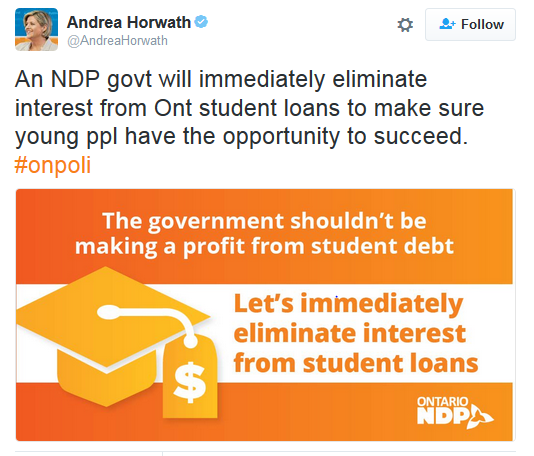

No, the problem isn’t so much the proposed program as it is the tagline that’s gone along with it. To wit: “The government shouldn’t be making a profit from student debt”.

I mean, where to begin with this stonking bit of nonsense?

The worst-case interpretation of this is that the NDP actually believes that “interest” equals “profit”, or, to put it another way, that money has no time-value. Read literally, it suggests that all interest is usury. The NDP is sometimes accused of being stuck in the 70s as far as economic policy is concerned; this particular slogan suggests it might be more 1370s than 1970s.

More likely, though, this is the NDP aping Massachusetts Senator Elizabeth Warren, who has been saying these kinds of things about US student loans for a few years now. The essence of the critique is this: governments borrow money cheaply and lend to students at a higher rate (in the US, the rate on Stafford undergraduate subsidized loans is the 10-year Treasury rate plus 250 basis points, and somewhat higher for other types of public loans). The gap between the two rates is needed because of course the government loses money on loans through loan defaults (it also loses money by assuming the loan interest while a student is in school, but that’s a separate issue). For reasons beyond comprehension, the US government does not base its financial calculations for student loans on actuarial reports which are linked to actual student behaviour, but rather according to “standard conventions”, one of which essentially assumes no loan losses at all. It is by using this convention – i.e. basically ignoring all actual costs – that Warren came to the conclusion that student loans “make money”. For a more complete description of why this is total nonsense, check out Jason Delisle’s work on the subject here as well as articles from the Atlantic, the Washington Post and the Brookings Institute.

But even to the limited extent the Warren critique makes sense in the US, it doesn’t work in Ontario. OSAP loses money. A lot of it. It doesn’t publish numbers directly on this, but it’s easy enough to work it out. Ontario 10-year bonds go for about 2.5% these days, and OSAP lends to students at prime + 1%, or about 3.7%. So Ontario’s spread is only 120 basis points, or half the American spread (CSLP loans, are different: the feds borrow at 1% and lend at prime plus 250 basis points, for a total spread of 420 basis points). 120 basis points per year is not much when you consider that simply covering the cost of borrowing while students are in school is twice that. Basically, it means that for someone who borrows for four years, the government loses money every time they pay back the loan in less than eight years. And that’s not counting the cost of defaults, which are in the tens of millions of dollars each year.

Put simply: Ontario students get to borrow at zero interest while in school, and positive-but-below-market rates after graduation despite default rates which are astronomical by the standards of any other personal loan product. That costs the government money. If it defrays some of that cost through an interest rate spread, so be it – that does not constitute “making a profit”. It is simply stupid of any political party which wishes to be entrusted with public finances to suggest otherwise.

Tweet this post

Tweet this post