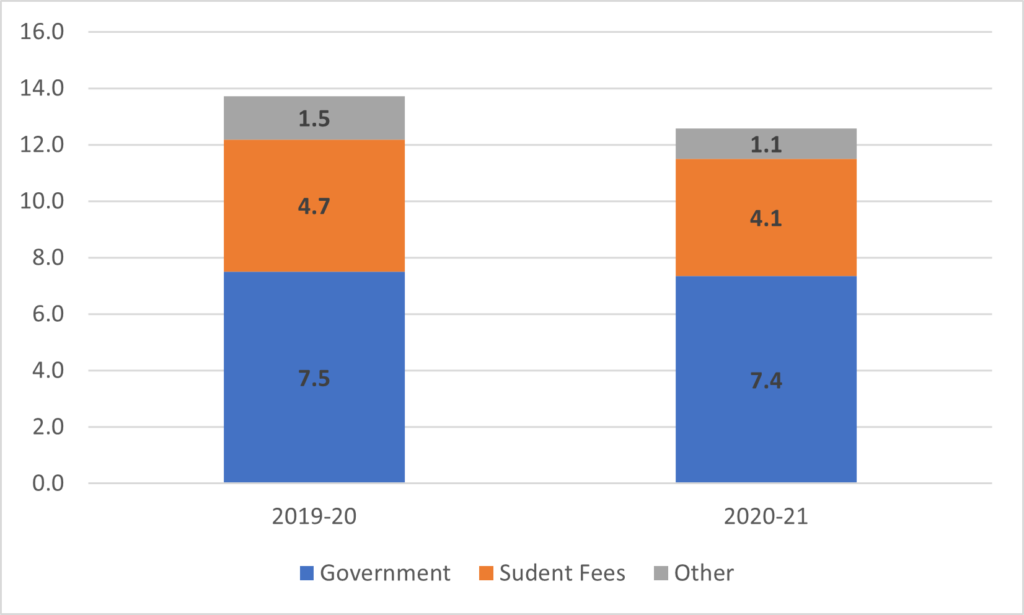

Let’s catch up on some new Statscan data on college finances during COVID. The big headline can be seen in figure 1: Total income for colleges dropped by 8.4% in real terms during 2020-21. About 40% of that fall was due to inflation, the rest was an absolute drop in income. But break it down by source of income, and you see something different: income from governments was down by 2%, income from student fees by 11%, and income from “other sources” (mainly ancillary operations income like food courts and residences) was down by nearly 30%.

Figure 1: Total College Income by Source, in Billions of Constant $2021 Canada, 2019-20 vs 2020-21

That’s steep.

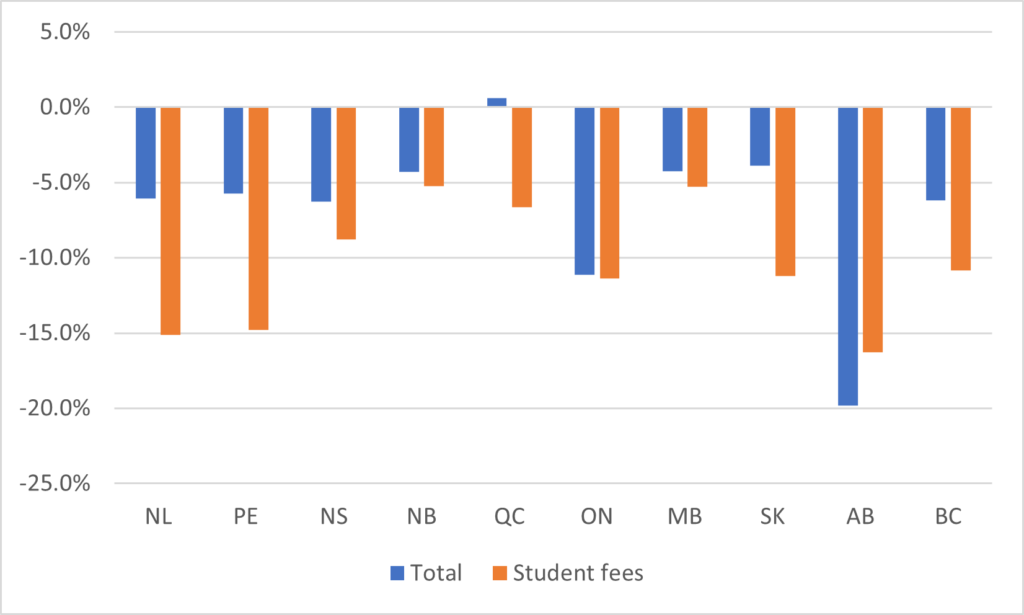

The breakdown by province is even more interesting. As I noted when looking at last year’s data (see figure 4): we have ten very different college systems when it comes to finances. In Ontario, something like 60% of funding comes from non-government sources, whereas in Quebec it’s about 15%. You’d expect that provinces with more government funding would be more insulated from this 8% drop: and as figure 2 shows, that’s true but there are still some intriguing things going below the surface.

Figure 2: One-year Change in Real Total and Student Fee Income for Colleges, Canada, 2021

Here’s how to interpret figure 2. First, institutions in all provinces saw declines in real income from student fees. In some provinces (New Brunswick, Manitoba), this decline was not much bigger than inflation (which was 3.6%), but six out ten provinces saw decreases of 10% or more in student fees. And yes, this includes the two most exposed to international students – Ontario and British Columbia – but there were big consequential falls in income from student fees in places like Newfoundland and Prince Edward Island. Second: note Quebec, which represents a pretty significant chunk of government funding to colleges in Canada: it was the one province where public finding not only increased in absolute terms but actually increased faster than inflation.

Third: boy does Alberta threw the whole curve off. Colleges took a hit of nearly 20% there, partly due to huge drops in student income but also because 2020-21 was the year the UCP government decided to implement major cuts in funding to post-secondary institutions. (N.B. here: I have not gone through all the footnotes on this release, but I know at least a few Alberta institutions changed their fiscal year-ends recently, thus resulting in a shortened fiscal year in 2020-21. If institutions are only reporting a shortened year, this would exaggerate the fall in all types of income and explain much of the magnitude of the drop).

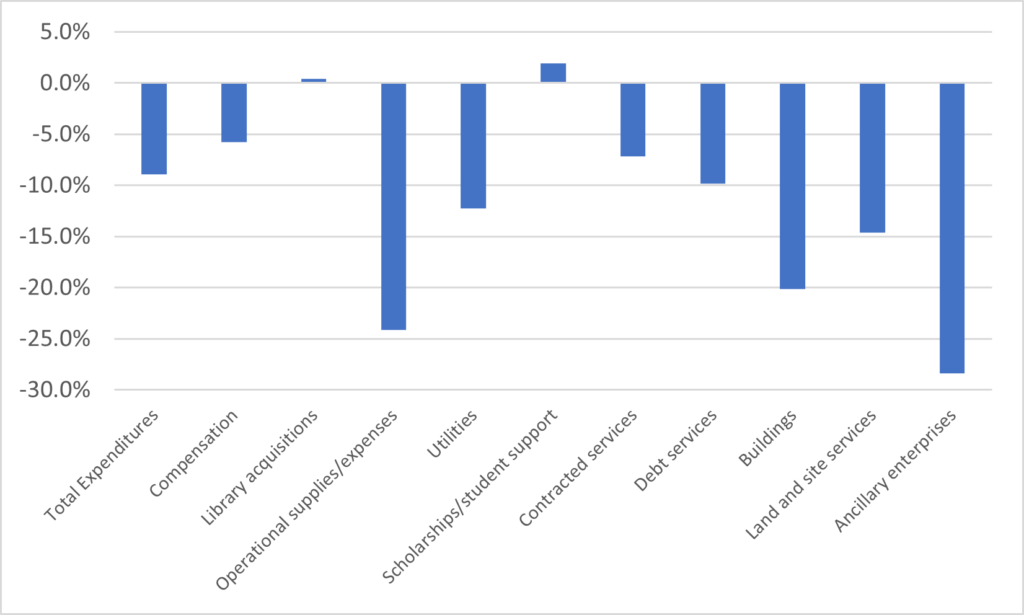

So what happened to expenditures? Well, it’s pretty much what one would expect. As figure 3 shows, the drop in income was more or less evenly matched by a drop in expenses, but most of the cuts were absorbed through cuts in operations: spending less on maintenance, supplies, etc. – all consequences of going partially or fully on-line, basically. Compensation fell – split pretty evenly between academic and non-academic salaries, which I didn’t expect – but two areas which increased even after inflation were library acquisitions and student support and scholarships.

Figure 3: Real Change in College Expenditures by Type, 2019-20 to 2020-21

To make a long story short: yes, colleges’ real market-generated income declined significantly, not just because of a loss of (mainly but not exclusively international) student fees but also because of a loss of ancillary income driven by closures of many campus services. But closures also generate savings, and to a considerable extent colleges the COVID-based reduction of in-person activity buffered the loss of income.

Tweet this post

Tweet this post