Yesterday, we examined student income during COVID. On aggregate, income might not have dropped at all once the Canada Education Student Benefit is taken into the equation, though there was probably some re-distribution of money away from students who work summers to those who don’t. Today, I want to look at what happened to institutions in the pandemic, because again the picture painted by the data emerging from institutional financial statements is quite different from the conventional wisdom about what happened.

The conventional story is this: when COVID hit, institutions that were overly dependent on student revenues were at risk of getting massacred because of the inability of international students to come to Canada. This narrative was sort of confirmed when Laurentian filed for bankruptcy back in February, claiming that a $5 million in lost income was the straw that broke the camel’s back (but only sort of, because Laurentian was actually one of the least-reliant institutions on international students). Fearing the worst, institutions began to economise in various ways, reducing expenditures to meet expected falls in income.

So, what happened? Well, we are now at the point where roughly half of Canadian universities have published their 2020-21 financial statements, so we can get a better sense of the actual financial hit. And…well, it’s not what you think.

As of yesterday, 34 universities had 2020-21 statements available. This includes all the institutions in Manitoba, Saskatchewan and British Columbia, nearly all the institutions in Nova Scotia (NSCAD and Ste. Anne excepted), about half the institutions in Alberta (MacEwan, Mount Royal and Alberta are yet to report), six institutions in Ontario (Brock, Queen’s Ryerson, Ottawa, Toronto and York) and one in Quebec (Montreal). Together, these institutions make up about 60-65% of total university spending in Canada, so what you see here is unlikely to change as the remaining financial reports emerge.

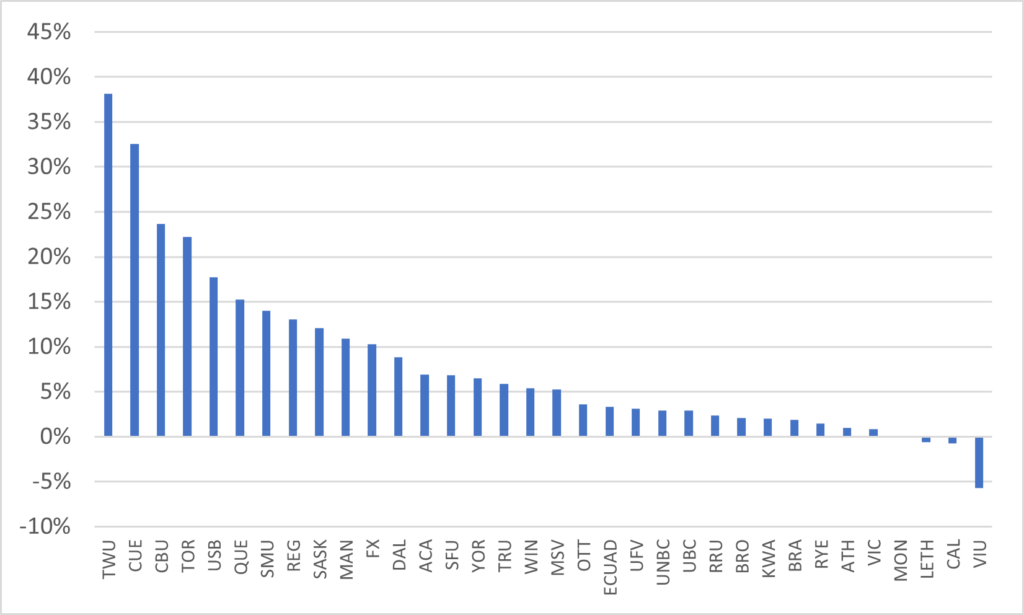

Of those 34 universities, 30 were in the black last year, the exceptions being Vancouver Island, Université de Montréal and – unsurprisingly given all the cuts in Alberta – Lethbridge and Calgary. Some of the surpluses are staggering: +$94 million at the University of Manitoba, +$121 million at the University of Saskatchewan, +$144 million at Queen’s and – hold on to your hats – +$726 million at the University of Toronto. Even Cape Breton University, the highly foreign-student-dollar-dependent university everyone assumed would get creamed by the pandemic, posted a surplus of $18 million on turnover of $98 million, which is still the highest margin return of any public institution in the country (Trinity Western and Concordia University of Edmonton still beat it quite handily though)

Figure 1: Net Surplus (Total Revenue Minus Total Expenditure) as a Percentage of Total Expenditures, 2020-21, By Institution

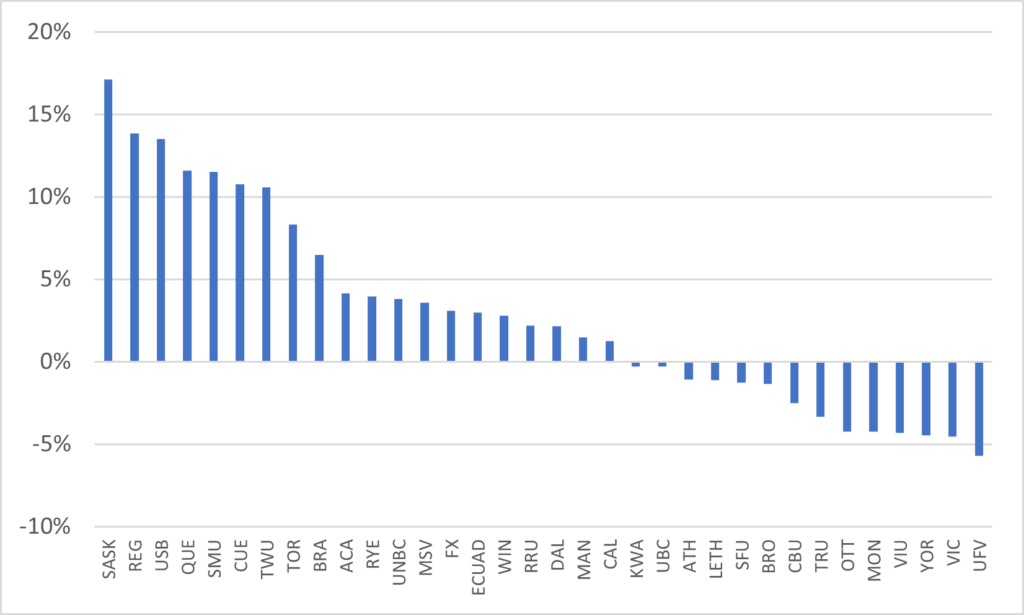

Now possibly you are saying to yourself “sure they might have surpluses, but we all know Canadian universities were (mostly) pretty flush pre-pandemic, so maybe they are still hurting a bit, with margins lower than before.” To which the answer is, on average, nope. In fact, in 20 of the 34 universities, the net surplus in absolute terms was larger in 2020-21 than it was in 2019-20. Yes, that’s right: on average, the pandemic was a better year financially for institutions than the pre-pandemic.

Figure 2: Change in Net Surplus as a Percentage of Total Expenditures, 2020-21, by Institution

How the heck did this happen? Well, apart from the University of Saskatchewan (where the turnaround was mostly due to a quite amazing uptick in the investment portfolio), the formula was pretty simple. Overall, university revenues rose slightly – about 2.6% in nominal terms – while expenditures stayed unchanged. Essentially, the savings from keeping campuses closed offset the usual 2-3% growth in salary costs.

A couple of points need to be made here. First, these are universities, not colleges, and all the indications are that colleges did get hit harder. So, this probably isn’t representative of the sector as a whole (I will try to do this exercise again for colleges in a few weeks when more statements are available). Second – hey turns out Laurentian wasn’t the canary in the coal mine! Though we don’t have Laurentian’s financials for 2020-21, if we take the claim that the university lost $5 million due to COVID, that would have marked out the university as having the second-worst performance of any institution in this survey. And third: maybe the vulnerability of the international student-centric model is overstated and it actually works just fine. Certainly, there doesn’t appear to be a lot of downside volatility (though again, the picture may be different with colleges).

In any case, the point here is: universities did not in fact lose money during the pandemic. They cut their budgets in anticipation of a fall in revenue and then the fall never came. They will be in good shape to deal with the next year or two when, I suspect, we will see a bit more labour militancy that we’ve seen for awhile. Add this to yesterday’s finding that students did not lose much if any money, and you have a story nobody (including us) expected. Not that anyone would want to admit it, but on aggregate (Laurentian being a rather glaring exception), COVID actually ended up being a non-story financially for the sector.

Tweet this post

Tweet this post

Your article reflects a similar situation in Australia.

Universities came through the pandemic relatively unscathed, dropping $A1.8 billion in revenue, compared to forecasts of $A4.4b a year ago.

39 of the 38 managed to maintain cash operating surpluses.

The most significant income fall was in the investment area as many universities switched to cash, and the “fair value” of investment holdings dropped with the fall in equities markets.

In many ways, COVID has been a call to address more deep-seated and fundamental problems in their business models and strategies.

There are some complex issues concerning Federal government investment in university research.

I have written a paper on this, which is at https://www.dropbox.com/s/yo3nb7h9oc73lnf/The%202020%20financial%20crisis%20in%20higher%20education%2030%20Sep.docx?dl=0

Kind regards

John

A bit late responding here but I wanted to add a comment based on our experience during Covid. I believe the main driver for post-secondary weathering the storm in fiscal year 20/21 was that we were able to retain most of the students we already had and even attract new International students because we all pivoted online. They didn’t have to be here in order to study. The real financial storm was just delayed, however, for the sector and the real impacts may well be felt this fiscal year (21/22). Now that most institutions are back to “normal”, with most programs going back to in-person delivery modes, International students are expected to be able to travel to Canada. As we have learned, this has proven very problematic for many.