So there’s a kerfuffle going on in New Brunswick about the government’s new “tuition-free” policy for students from families with under $60K in income which I mentioned in passing a couple of weeks ago. Basically, the problem is that the government drew up the program hurriedly, on the back of an envelope, and didn’t think through the consequences.

If you just listen to the launch announcements, the new New Brunswick program is similar to the new Ontario program (which you may recall I praised to the skies: Ontario promised “free tuition” (actually, grants equal to or greater than average tuition) for “low and middle income families” while New Brunswick promised grants equal to tuition for anyone with family incomes under $60,000. Same, right?

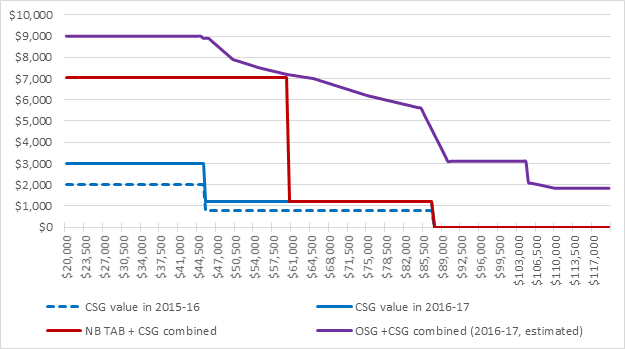

Wrong. The difference is that the Ontario program has a long phase-out. That is, grants fall as income rises, but gradually. In New Brunswick, they drop off a cliff at $60,000. A student from a family with income of $59,999 will get (effectively) $7,000 or so in grants, but at $60,001, you’re only going to get about $1,200. Figure 1 shows eligibility for federal grants (in blue, for 2015-16 and 2016-17), and the New Brunswick Tuition Access Bursary (TAB) and the Ontario Student Grant (OSG) – the OSG line is a bit messy, and I assume it will actually be a bit smoother than this, but this is a best-estimate based on the Ontario budget papers).

Figure 1 – Eligibility for Grants, Ontario Study Grant Vs. New-Brunswick Tuition Access Bursary

In the business, this is what’s known as a “step-function”, and is generally best avoided because it creates all sorts of weird incentives. In this case, a New Brunswick family with two parents earning $30,000 each and a kid in university will be way better off rejecting a salary raise than they would be accepting it, as their kid would lose $5800 in grant funding every year.

But the problem in New Brunswick goes deeper than that. It’s not just that such parents will lose money in the future, it’s that they are going to be worse off than they are now. New Brunswick is paying for this move by ditching the provincial tax credits for tuition and education, and this elimination is on top of the federal government ditching its education and textbook tax credits to pay for the upgrade in federal grants. What this means is that everyone in New Brunswick will lose about $1600 worth of tax credits. For those at the low-end of the income scale, that’s fine, because this will be offset by the higher grants. But for a family earning $60,001, they will be losing that $1600, but only gaining $400, thanks to the increase in federal grant. Something similar happens in Ontario as well, but only once you get past about $110,000 in family income. In New Brunswick, we’re talking about taking away $1200 per year in aid from people earning $60,000. That’s a big, nasty hit.

You may well ask “why didn’t New Brunswick have a more phased-out reduction”? Well, it’s hard to tell. The minister, after claiming her program was identical to Ontario’s, later told CBC that she had no idea Ontario had a phase-out and New Brunswick didn’t. Which is, you know, a bit worrying. But the bigger reasons are that New Brunswick a) has never spent that much on student aid, and so didn’t have as big a base of money to redistribute as Ontario and b) appears to have only re-invested half the money it saved from axing various tax credits (that’s an estimate – it hasn’t been super-transparent with cost estimates of the program; one wonders if this isn’t the reasons the government didn’t announce this measure as part of the budget where the figures would have been more transparent). Had it re-invested more fully, New Brunswick probably would have had enough money to do an Ontario-style phase out.

Now, in addition to having announced a flawed policy, the Government of New Brunswick has annoyed the crap out of me personally by claiming that I provided the inspiration for said policy. To that end, it appears to have been handing out partial copies of a paper produced for the previous government in 2011-12. Since my client has been (selectively) leaking my work, I don’t particularly feel bound by any of the usual confidentiality provisions. So here’s what actually happened:

HESA did do some work for the New Brunswick government – specifically, the Ministry of Advanced Education and Labour – in the fall of 2011. We were asked two questions. One, were the back-end subsidies New Brunswick was then using (a timely-completion loan remission program, the usual tuition & education tax credits and a graduate tax benefit) effective? Two, could we come up with some more interesting ways to use that money?

To the first question, we answered no, for a variety of reasons which, if you’re a regular reader, you can probably guess. To the second question we said the money should be used three ways. One, a new grant program to deal with “unmet need” (that is, need in excess of current aid maximums), which primarily would have benefitted students with dependents. Second, because student debt and repayment is a much more serious problem in the Maritimes than it is in the rest of the country (because of higher debt & lower graduate incomes), we suggested a hard debt-ceiling of $7,000 per year, with the remainder turned into grants. Last, we suggested some investment in early-intervention programs. We did NOT suggest anything like what the provincial government has done. And frankly I’m more than a bit teed off the present government chose to publicly present our findings that way.

Bottom line: getting rid of tax credits is good. Re-investing funds in a way that concentrates more spending on lower-income students is good. Bravo to New Brunswick to getting those two things right. But details matter. This government got the details wrong by not fully re-investing and putting too high a burden on middle-income students. It needs to fix this.

2 Responses

You are spot on. It needs to be fixed. I am all for promoting Higher education, but you really need to think things through. My proposal to the current provincial government would be to offer the first two terms of 2016, starting in the fall term, at all higher education facilities that qualify, free of charge, to all New Brunswick residents. At the end of your your second term, your success will determine how much of a grant you receive for your third term and so on until you graduate. The better your marks, the better the grant. Set the parameters and include everyone in the program low, middle and upper income levels. That said we also have to work on retaining our granted students once they graduate to make any program like this have any value to New Brunswick.

Hilarious!