Hi all. How’s the summer working out so far?

I promised I would be back with a blog just as soon as the folks at the Canadian Undergraduate Survey Consortium (CUSC) published their triennial survey of graduating students, which is the most regular and arguably the best source of information we have on student debt. Which they did on June 27, so here I am.

(Why is CUSC the best source? Well, the feds can’t publish such data because CSLP has no idea how much money provinces are giving out. The provinces could publish data but don’t, because reasons. National Graduates Survey has similar data but it’s only every five years and is three to four years out of date when it is published. So, this is really the best we’ve got. It’s not great, because the list of participating schools changes somewhat, and it largely excludes Quebec, so what you’re really seeing is an English-Canadian average. But in the absence of anything better, this is the best).

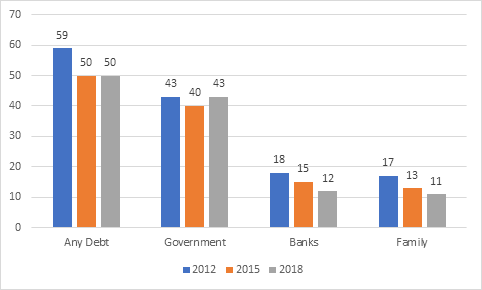

In terms of the proportion of students borrowing, 43% of graduating students indicate they borrowed from public student aid programs, 12% said they borrowed privately from banks and 11% said they borrowed from family. Because a few students borrow from more than one source, the total indicating they borrowed from any source was 50%, exactly the same as in 2015 and down somewhat from 2012.

Figure 1: Percentage of Graduating Students With Debt, by Source, 2012-2018

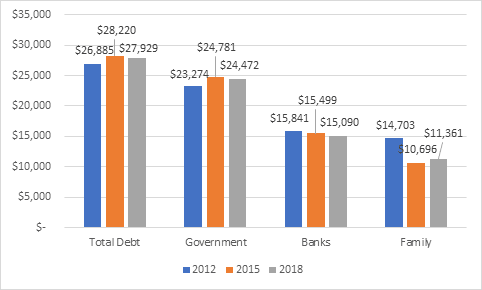

As for the amounts borrowed by students with debt, these too look more or less the way they did in 2015. Adjusted for inflation, borrowing from government sources was down 1% since 2015 (to $24,472), and total borrowing down by slightly less than that (to $27,929). This obviously masks some variation between provinces – specifically, that debt is probably down in Ontario and up everywhere else, and of course it largely ignores Quebec (back of the envelope calculations indicate adding Quebec would bring down the national average by about 10%, so a true national average is probably in the $25-$26,000 range). But in any case, we are really not seeing much in the way of change here.

Figure 2: Average Debt by Source, Students with debt >$0, 2012-2018, in constant $2018

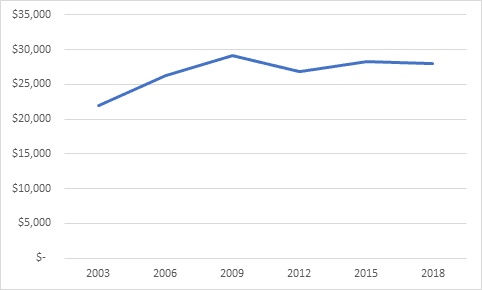

If you want a slightly longer look at that debt figure, figure 3 shows average debt among graduating students since 2003, the year in which CUSC first started asking about debt. Student debt was certainly rising in the early 2000s, but in the last decade or so, the overall student debt figure has been very stable.

Figure 3: Average Total Borrowing, Students with debt >$0, 2003-2018, in constant $2018

In short, the data demolishes the idea, beloved of the usual suspects and parts of the left, that student debt is “skyrocketing” or that education is ever more “unaffordable” across Canada. Yes, it is increasing in some places (most notably Alberta), but it is declining in others (Ontario). And repayment burdens are much lower than they were fifteen years ago thanks to much lower interest rates and lower tax rates. Student debt remains a problem largely under control. Anyone telling you otherwise is simply not telling the truth.

Tweet this post

Tweet this post

So what this says to me is that we’ve made no progress whatsoever on this issue.

Debt has stayed relatively constant despite 3-5% annual increases in the total cost of attending – the needle hasn’t moved much, but the last few years data seem to show debt load falling behind cost, which is a good thing (although it’s also likely linked to the rosier economic picture in recent years).

Do they ever do median debt? I’d love to know how much the average and trends are driven by debt for high priced programs.

Is it possible to separate out graduates from drop-outs? Repaying higher debt with a salary boost (graduate) is considerably easier than repaying low debt with no salary boost (drop-out). In the US, the default rate for the latter group is considerably higher, and seeing the 2- or 5-year default rates might help answer @Stephen Downe’s point (“So what this says to me is that we’ve made no progress whatsoever on this issue”) as to whether progress has been made. If the default rates are decreasing, then that provides clear evidence of progress.