Note: this is a short version of a paper which has just appeared in issue 72:4 the Canadian Tax Journal. How short? I’m trying for under 1000 words. Let’s see how I do.

Canadian student aid programs existed in scattered forms since just after World War I but became a “national program” when the Dominion-Canadian Student Aid Program (DCSAP) was created in 1939. Under this program, the Government of Canada provided block cash grants to provinces who administered their own scholarship programs which provided aid based on some combination of need and merit. The actual details of the program varied significantly from one province to another; at the time, the government of Canada did not place much importance on “national programs” with common elements.

In 1964, this DCSAP was replaced by the Canada Student Loans Program (CSLP)—recently re-named the Canada Student Financial Assistance Program (CSFAP). This has always been a joint federal-provincial enterprise. But where the earlier program was a block grant, this program would be a single national entity run more or less consistently across all provinces, albeit with provincial governments still in place as responsible administrative agencies able to supplement the plan as they wished. Some provinces would opt out of this program and received compensation to run their own solo programs (Quebec at the program’s birth, the Northwest Territories in 1984 and Nunavut in 1999). The others, for the most part, built grant programs that kicked in once a student had exhausted their Canada Student Loan eligibility.

Meanwhile, a complimentary student aid program grew up in the tax system, mainly because it was a way to give money to students that didn’t involve negotiations with provinces. Tuition fees plus a monthly education amount were made into a tax deduction in 1961 and then converted to a tax credit in 1987. Registered Education Savings Plans (RESPs), which are basically tax-free growth savings accounts, showed up in 1971.

Although the CSLP was made somewhat more generous over time in order to keep up with rising student costs, program rules went largely unchanged between 1964 and 1993. Then, during the extremely short Kim Campbell government, a new system came into being. The federal government decided to make loans much larger, but also to force provinces in participating provinces to start cost-sharing in a different manner—basically, they had to step up from a student’s first dollar of need instead of just taking students with high need. Since this was the era of stupidly high deficits, provinces responded to these additional responsibilities by cutting the generosity of their programs, transforming from pure grants to forgivable loans. For the rest of the decade, student debt rose—in some cases quite quickly: in total loans issued doubled between 1993 and 1997.

And then, everything went into reverse.

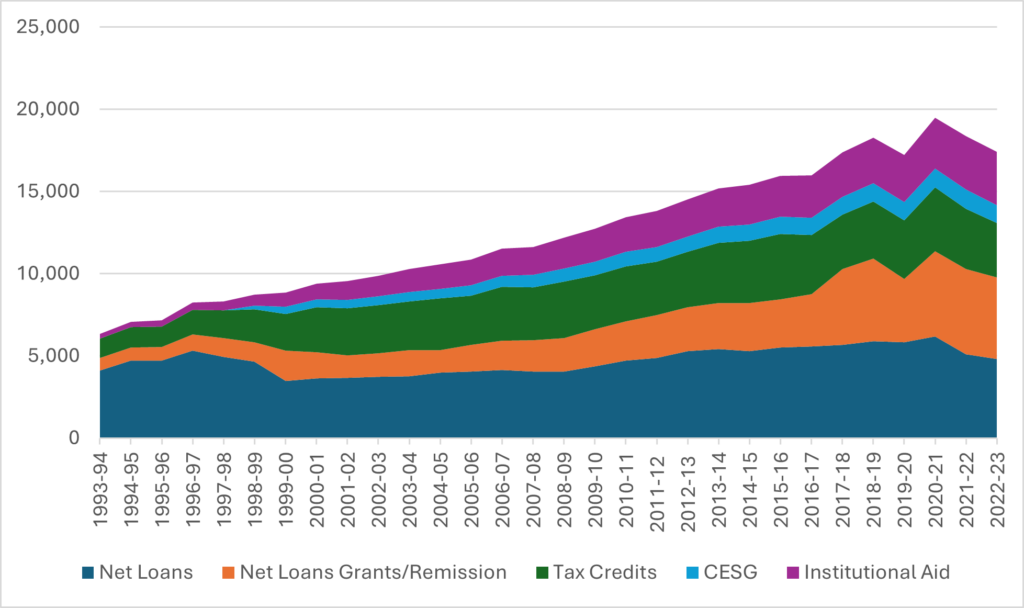

In a series of federal budgets between 1996 and 2000, billions of dollars were thrown into grants, tax credits and a new program called “Canada Education Savings Grants,” which were a form of matching grant for contributions to RESPs. Grants and total aid rose; loans issued fell by a third, mainly between 1997 and 2001 (a recovering economy helped quite a bit). Tax expenditures soared, which due to a rule change allowing tax credits to be carried forward meant either students got to keep more of their work income or got to reduce their taxes once they started working.

Since this period of rapid change at the turn of the century, student aid has doubled in real terms. And nearly all of that has been an increase in non-repayable aid. Institutional scholarships? Tripled. Education scholarships? Quadrupled. Loans? They are up, too, but there the story is a bit more complicated.

Figure 1: Student Aid by Source, Canada, 1993-94 to 2022-23, in thousands of constant $2022

For the period from about 2000 to 2015, all forms of aid were increasing at about inflation plus 3%. Then, in 2016, we entered another period of rapid change. The Governments of Canada and Ontario eliminated a bunch of tax credits and re-invested the money into grants. Briefly, this led to targeted free tuition in Ontario, before the Ford government took an axe to the system. Then, COVID hit and the CSFAP doubled grants. Briefly, in 2020-21, total student aid exceeded $23 billion/year (the figure above does not include the $4 billion per year paid out through the Canada Emergency Student Benefit), with less than 30% of it made up of loans.

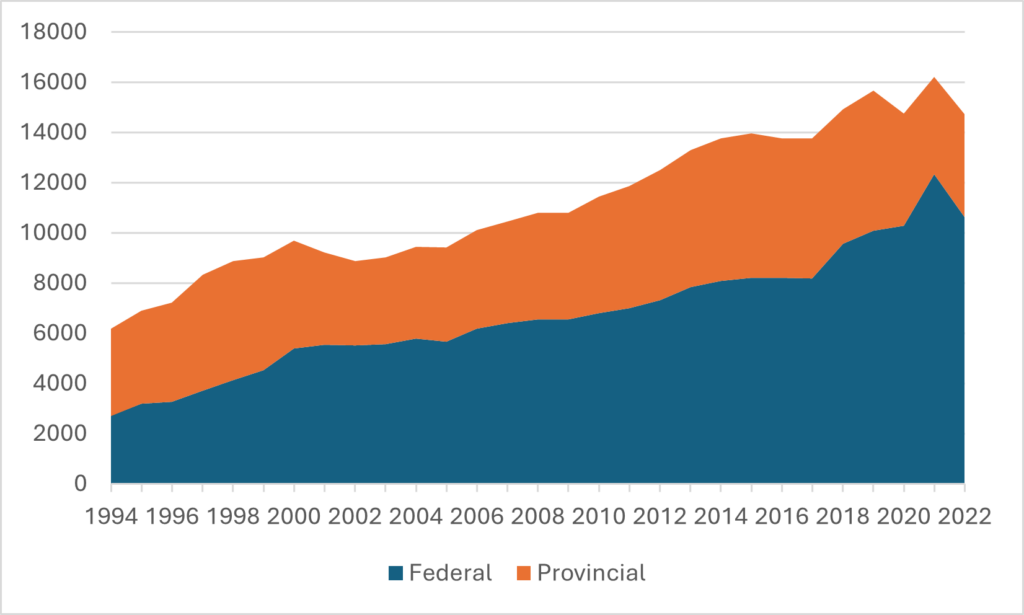

One important thing to understand about all this is that while the system became much larger and much less loan-based, something else was going on, too. It was becoming much more federal. Over the past three decades, provincial outlays have risen about 30% in real terms; meanwhile, federal ones have quadrupled. In the early 1990s, the system was about 45-55 federal-provincial; now, it’s about 70-30 federal. It’s a stunning example of “uploading” of responsibilities in an area of shared-jurisdiction.

Figure 2: Government Student Aid by Source, Figure 1: Student Aid by Source, Canada, 1993-94 to 2022-23, in thousands of constant $2022

So there you go: a century of Canadian student aid in less than 850 words. Hope you enjoyed it.