Note: since the publication of this post, Concordia University and St. Thomas University have provided responses disagreeing with the assessment of this post. Click the university names above to read their respective positions.

So, the mixed metaphor I keep hearing is that Laurentian is the canary in the coal mine, and there must be other dominoes ready to fall. And people seem to assume I know who is next. In fact, my priors are that there are probably not any other institutions in a similar position, but hey, it’s always good to revisit priors, so today I’m going to try to stress test the country’s most vulnerable institutions.

Let’s start by defining our universes. Last summer, for the State of Post-Secondary Education in Canada 2020, I worked through every Canadian university’s last two sets of financial statements (at the time, 2017-18 and 2018-19). On the basis of this, I could see who was in persistent financial trouble – institutions which have run deficits in both years. It turned out there were eight of these: Mount Saint Vincent, Ste. Anne, St. Thomas, UNB, Concordia, Nipissing, Laurentian, and OCAD University.

And then for these eight universities, I looked at their financial statements data from 2012-13 right through to 2019-20 to see how they all fared in comparative perspective (data from Ste. Anne was only available from 2015-16). My first cut was pretty simple: I looked at revenues and expenditures before any interfund transfers. In a couple of cases I may be doing a bit of violence to the numbers by reporting them this way, but on the whole it works out.

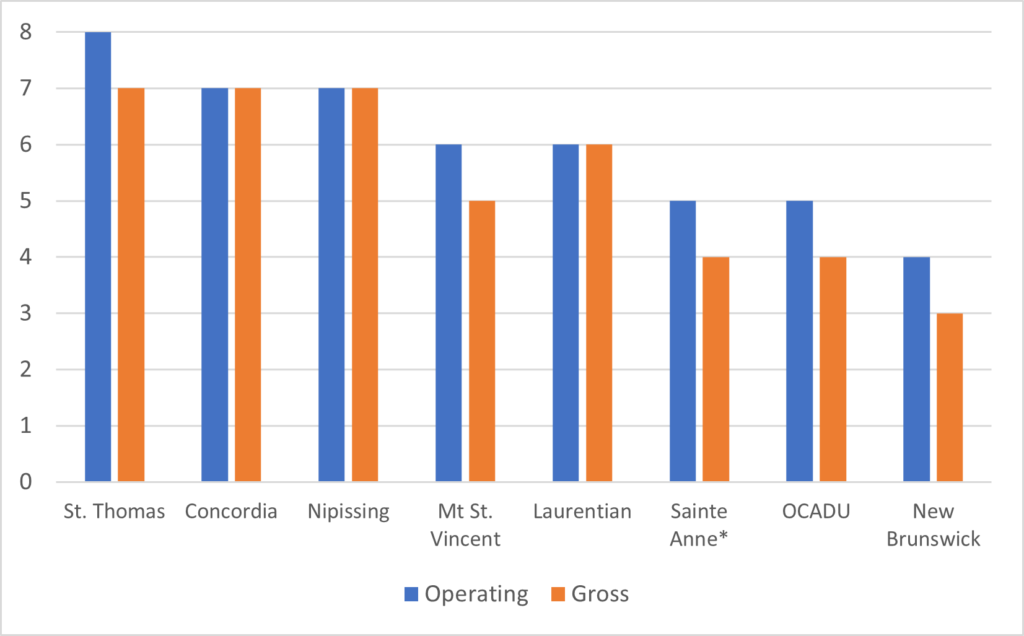

There are a couple of challenges in doing this. The main one has to do with whether to include donations in the revenue column or not. To the extent that donations end up in the endowment, you should not include them in the balance sheet because they are not available to cover costs. But on the other hand, there is no way to know from these statements how much is for endowments and how much is not. So, what I do below is show them both ways. When I label something “gross operating margin”, it is just revenue minus expenditure; when I label it “net operating margin”, it is revenue net of donations, minus expenditure. Make up your own mind which is correct. (And note that Laurentian alone among these institutions does not separate out donations in its financial statements, so Laurentian’s numbers are always gross). OK, so let’s start with the question of which of our eight institutions have been in persistent deficit. Laurentian has by no means been the worst offender. Concordia, Nipissing and St. Thomas have all been in deficit for seven of the last eight years; if you exclude donations then St. Thomas has been in deficit continually since 2012-13. Note that while Ste. Anne looks comparatively good on this measure, there is only five years of data available for them, meaning in fact they, like St. Thomas, have been in deficit pretty much the entire time for which data is available.

Figure 1: Years in Deficit since 2012-2013, Select Canadian Universities

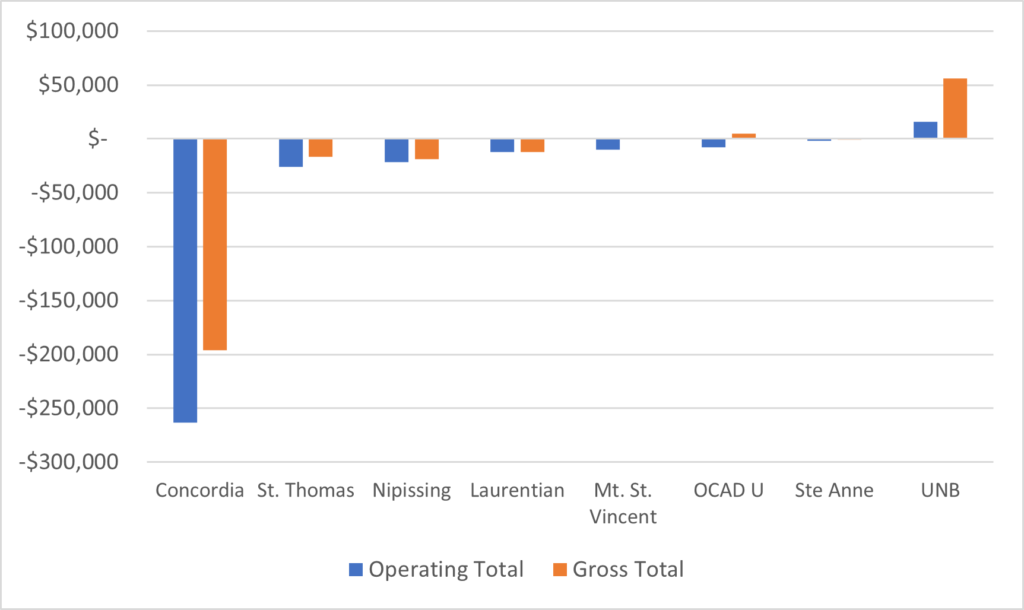

Now, let’s look at the size of those accumulated deficits. In Figure 2, I show the cumulative deficit of these eight universities over eight years. On the right-hand side of the table, you can see that UNB is in surplus over the eight years, meaning that although it is currently in a bit of a rough spot, on the whole it has had reasonably good finances over the eight years, and we should maybe take them off our list of problem institutions. The real story is over on the left-hand side of the graph. You are not reading that wrong. Concordia has indeed over the last eight years spent $195 million more than it took in – $263 million if you exclude philanthropic donations. From what I can glean from the financial statements, it’s not so much that Concordia’s operating budget isn’t balanced, but rather that the institution is transferring tens of millions of dollars a year into its capital account for reasons which are not entirely clear from public documentation.

Figure 2: Accumulated Deficit, since 2012-2013, in Thousands, Select Canadian Universities

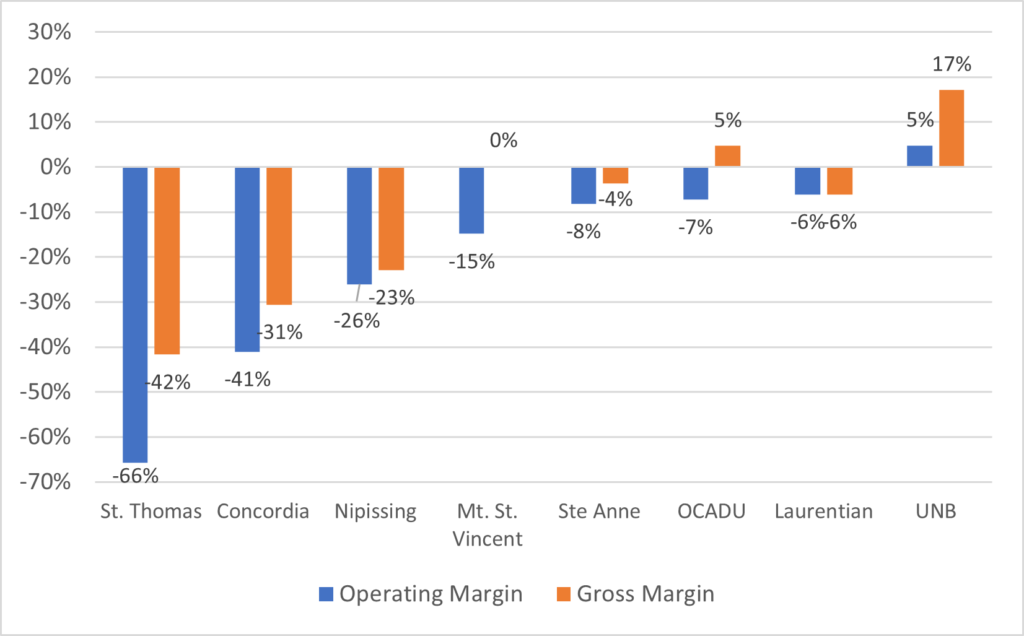

Figure 3 takes the same data in Figure 2 and portrays it as a percentage of 2019-20 income – essentially a debt-to-income ratio, which is always a better way to think about potential financial overreach. Now it’s not quite debt-to-income because it’s only taking short-term debt into account – long-term debt for capital improvements is not included here. It’s just accumulated deficits over eight years divided by the most recent year’s income. And what we see here is that Laurentian’s situation over the past eight years was by no means the worst. In fact, three universities have been racking up deficits at a much faster rate. Nipissing’s accumulated deficits, at a minimum, are 23% of 2019-20 income. At Concordia, it was 31%, and at St. Thomas, 42% (the higher numbers, which exclude philanthropy, need to be taken with salt – my guess is that if these institutions are in persistent difficulty balancing budgets, then philanthropy is mostly going to go to operating budgets and not endowments, so the true figure will be closer to the lower number).

Figure 3: Accumulated Deficit, since 2012-2013, as a Percentage of 2019-20 income, Select Canadian Universities

Now, no one can say on the basis of this that any of these institutions is definitely headed the way of Laurentian. After all, a substantial portion of the problem at Laurentian was not “visible” from financial statements, and in principle any of these institutions can probably keep things ticking over for as long as their bankers keep extending their lines of credit (also: let’s hope they all have more than one bank account!).

But that’s the problem with consistently running deficits: you put yourself in the hands of bankers. You make your whole operation more brittle and less resilient in the face of adversity (like, say a global pandemic). Nipissing, St. Thomas and Concordia might not be in immediate danger of insolvency, but a path of constant deficits is dangerous. At the very least, some big warning lights need to be flashing at these three institutions.

Tweet this post

Tweet this post

Hello Alex,

So their are a few questions going forward. Laurentian has been using let us say… Creative Accounting to stay afloat, it would not be a stretch to think that some others you mention are in the same boat. Do we as a community insist the government step in? Provincial auditor or something similar?

Perhaps more importantly what do we say to students who are considering Laurentian for next year? As this is new ground, do you take a chance on sending your student there.

Tough stuff. Any guesses on how the CCAA will shake out.

Cheers