Yesterday, we noted that Canada hands out over $10 billion to its students each year. Of that, $6.6. billion goes to students in the form of tax credits or grants; another $700 million is spent on savings incentives of various sorts. All told, over 70% of the $10 billion is non-repayable.

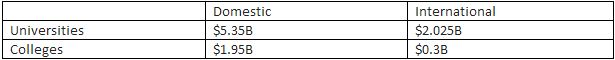

How does that compare to what students spend on tuition? Well, this isn’t entirely straightforward. We know from CAUBO/Statscan statistics that in 2011-12, universities collected $7.37B in fees from students. What we don’t know is how much of this comes from Canadian students and how much comes from foreign ones. At best, what we can do is approximate. The Canadian Bureau for International Education (CBIE) says that in 2011, there were 131,500 international students in Canadian universities, of whom roughly 12% are doctoral students. Stastcan says that in that year, international undergraduate fees averaged $17,500. Let’s assume that the doctoral students among them are paying zero, but the rest are paying full freight. That means: .88 times 131,500, times $17,500 = $2.025 billion in foreign student fees. And by extension, $ 5.35Bn in domestic student fees.

What about on the colleges side? That’s a little more fuzzy. For starters, the latest college data I have floating around the office is from 2007-08 (it’s a free email, people, you get what you pay for). It showed colleges collecting a little under $1.9 billion in fees (in $2011) from all sources, including continuing ed and trade-voc programs. Build in a wee bit of growth and we’re probably talking about something in the neighbourhood of $2.2 billion in terms of total fee intake.

What share of that is domestic? Again, it’s fuzzy. The CBIE data isn’t clear about colleges’ share of international students, but it’s probably the lion’s share of “trade” and “other PSE” combined, so call it about 18% of the 239,000 international students here in 2011, or about 43,000 in total (Colleges Ontario’s 2012 environment scan says there were 18,000 international students in Ontario alone in 2011, so that seems about in the ball park). We have absolutely no idea what international student fees are in colleges because nobody tracks that, but let’s really low-ball it and say the average is $7,000. That would imply international student fee income of about 300 million on the nose, and, by implication, a domestic tuition “take” of $1.9Bn.

So, just to tally things up here:

Total domestic tuition income in = $7.3 billion. That’s almost exactly, on the nose, what goes out in non-repayable aid to students and their families each year.

Net zero tuition. I’ll look at the implications tomorrow.

8 Responses

Great series so far. When do we get to see need-based aid ÷ tuition paid by students below median household income? In Quebec, you’d see that the *grant alone* exceeds 100% of tuition for low-income students.

For this fall, we’re going to calculate net prices for 6-10 model students in every province across Canada. Antidote to the Statscan tuition thing.

Wow – this is incredible!

I guess, by this logic, Canadians pay net-zero tax, since every dollar paid in income tax is then turned back out in government spending to Canadian taxpayers and corporations. I never thought of it that way, but it’s brilliant!

Clearly, everyone should stop complaining about having to pay both tuition and taxes, since the money going out is equivalent to the money going in.

This is actually true. Government spending and private spending are exactly the same in economic terms. The difference is who decides what the money is spent on, and now. In an efficiently run democratic country high progressive taxes lead to more public goods that everyone can access because they are citizens — healthcare, education, solid public pensions, a good employment insurance program, infrastructure, an accessible legal system, etc. People and companies are paid to deliver those services and their income filters through the rest of the economy like everyone else’s. So it’s all a wash.

The alternative is low taxes and more private spending on … you know … chia pets, movie tickets, $200 trips to the salon, iphones, gourmet coffee, and — especially — huge mortgages for too much house (I realize “too much house” smacks of a value judgment.)

In my view our country has swung too far to the private spending side. I see overbuilt subdivisions going up all over while community centres close, people have trouble finding a family doctor, roads and bridges fall apart and cuts are made to food inspections and national institutions. Galbraith called it “private wealth and public squalor.”

The simple way to deal with post-secondary education funding is to replace domestic tuition fees, loans and grants, with full funding from government directly to institutions, just like public school. A progressive income tax system would pay for it.

Everything is too complicated now, too much is wasted on administration and there is a great amount of stress on the part of students and parents. Everyone benefits from a society in which anyone can access post-secondary education according to interest and ability — whether a robust apprenticeship program for trades, technical or community colleges, universities, etc. We could learn a lot from Germany.