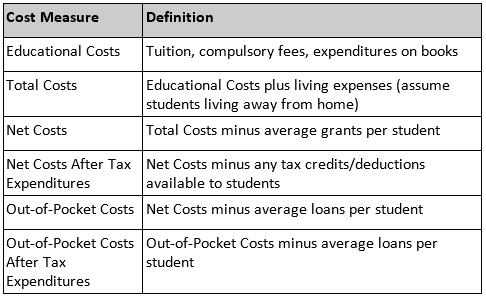

First, a brief methodological note on this comparison. We take six different measures of cost (see table below) and divide each of them by each nation’s median household income. We do this because affordability by definition is a function of a household’s ability to pay – simply comparing costs, which on their own are meaningless.

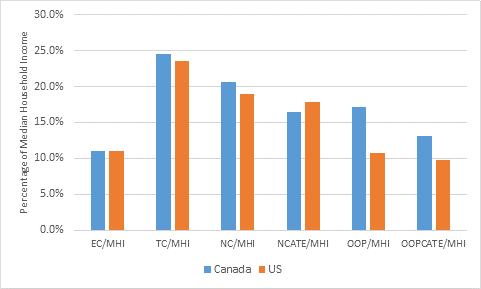

In our 2006 paper, we used US figures for on-campus housing and in Canada we used results from an Ekos survey for living expenses. Here’s how affordability stacked up then:

American tuition and living costs were both 15-20% higher than Canadian ones, but once adjusted for household income they were roughly the same – education costs in both countries came out to 11% of median household income and total costs were 23-24%. Where the Americans had a real advantage was in loans: the ubiquity of loans meant that Americans were much less credit-constrained than Canadians and had to dig into their pockets much less in the short term. Result: on the most inclusive measures of affordability, Americans looked better than we did in 2002-03.

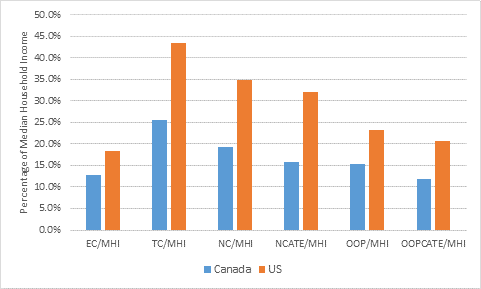

Now on to a more recent comparison, after a recession and many policy changes on both sides of the border. We’ve refined the US living cost data by using a weighted average of on-campus and off-campus housing costs, and to make the Canadian data more comparable we’ve chosen to use CSLP living cost estimates for Canada rather than actual survey data (nationally, the two are within 5% of one another, so it’s not a big change in practice). Here’s how the data looks for 2013-14:

Figure 2: Canada vs. US Cost Comparisons, 2013-14

What happened? How does Canada now look so much more affordable? Well, not much on the income side; in fact US median household income grew slightly faster on the American side. But tuition grew a lot faster in the US than it did in Canada. So, interestingly, did American students’ living costs; in 2003 they were 18% higher than in Canada; now they are 86% higher. To some extent, the increase in US living costs is due to our methodological change of including off-campus housing costs. That said, US cost of attendance is truly rising quickly for reasons which are not entirely clear.

Some policy measures have kicked in to offset these rises. Grant dollars per student in the US have risen by over 170% in the past decade, and loans per student have risen 64%. Both these figures far outstrip the equivalent figures in Canada. But it’s not enough to close the widening cost gap. On the most inclusive measure of affordability – out-of-pocket costs after tax expenditures – Canadian families must spend 11.9% of median household income (compared to 13.1% a decade ago) while Americans must spend 20.8%, up from just 9.7% a decade ago.

Plenty of food for thought – on both sides of the border.

One Response

There seems to be an error in your definitions:

Out-of-pocket costs = Net costs – average loans

Out-of-Pocket Costs After Tax Expenditures = (Out-of-pocket costs) – average loans

Out-of-Pocket Costs After Tax Expenditures = (Net costs – average loans) – average loans ?