Nearly all universities have posted their financial statements for 2021-22, so that means it’s time to look at how year two of COVID went for Canadian universities.

Let’s define who is included in the sample. Not all institutions have put out their 2021-22 financials including: Algoma University, the Nova Scotia College of Art and Design, Concordia University, Université Laval, Polytechnique, and the Université du Québec system, so these cannot be included. I have also left out Mount Royal University and Grant MacEwan because they recently changed their year-ends meaning that the ‘22 fiscal is only nine months long. Laurentian University I have left out because there is so much carnage on the books it’s not worth including them in a comparison. But apart from that, everyone is in.

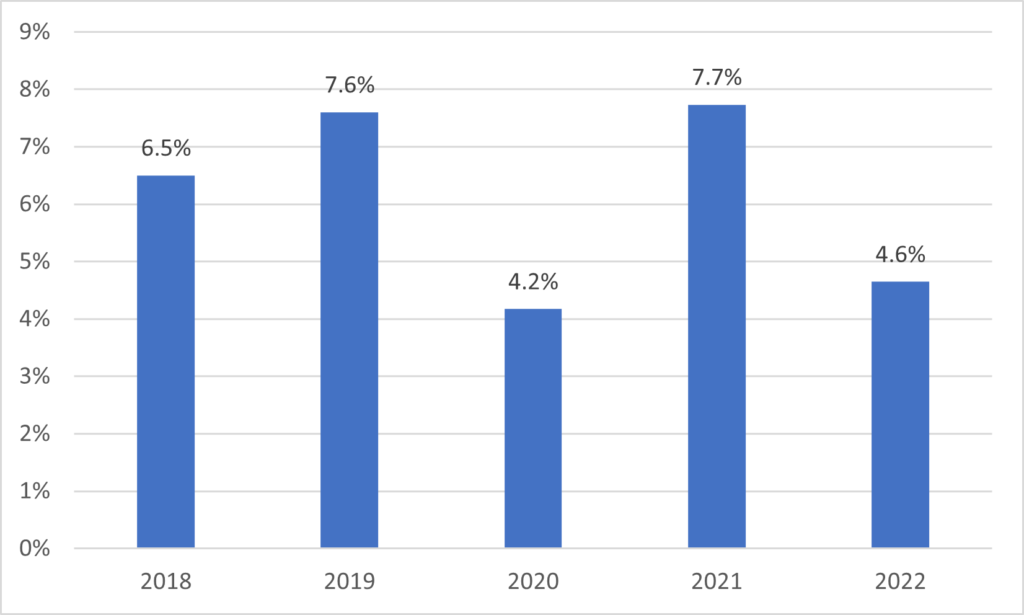

Figure 1 shows us the bottom line: that is, net surplus as a percentage of total expenditures across the entire system. What we see here is that last year, 2021-22, the net surplus was 4.6%: substantially lower than the previous year, but slightly better that the 2020 year which saw large-scale disruptions at the end of the fiscal, both because of hits to ancillary income but also because of declines in equity portfolio values. Four and a half percent is a pretty good number. It implies that institutions overall are in pretty solid shape and able to squirrel away money for the future but not actually profiteering.

Figure 1: Aggregate University Net Surplus as a Percentage of University Expenditures, 2017-18 to 2021-22

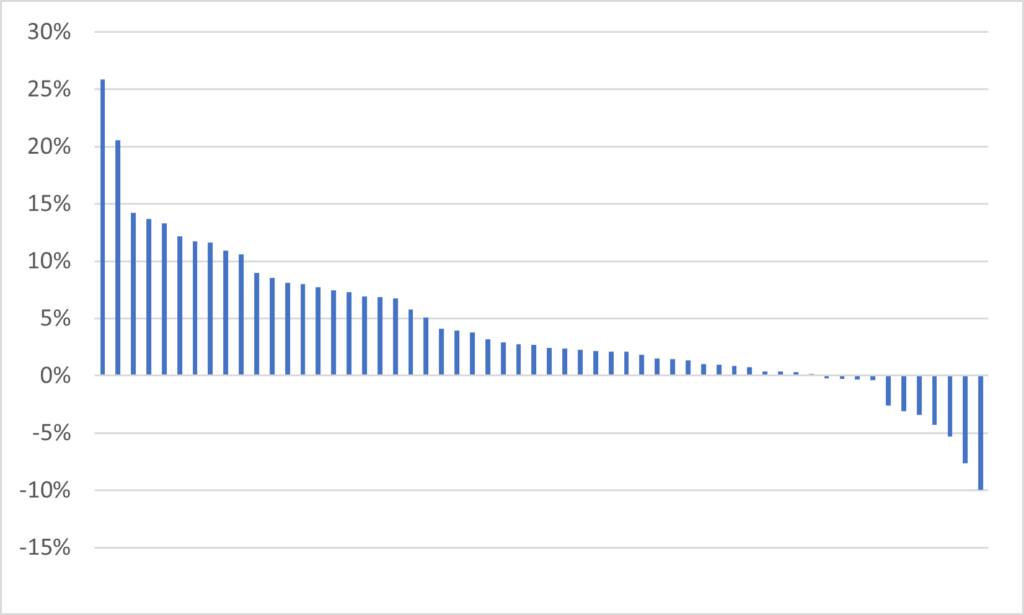

Figure 2 shows the distribution of surpluses by institution (sorry for the lack of a legend – there’s no way to fit that many institutional names on a graph that side). What it shows is that there are about 4 times as many institutions with surpluses as there are with deficits. Several institutions did extremely well last year. Trinity Western posted a surplus of 26%, Concordia University of Edmonton 21%, Moncton and Cape Breton 14%, Bishop’s 13%, Toronto, UPEI and Montreal 12% and Lethbridge and Western 11%. Meanwhile, a few institutions posted net deficits last year: Carleton, NOSM and Vancouver Island all posted losses of about 3%, Guelph 4%, Nipissing 5%, Saint Thomas 8% and Lakehead 10%.

Figure 2: Distribution of university net surpluses, 2020-21

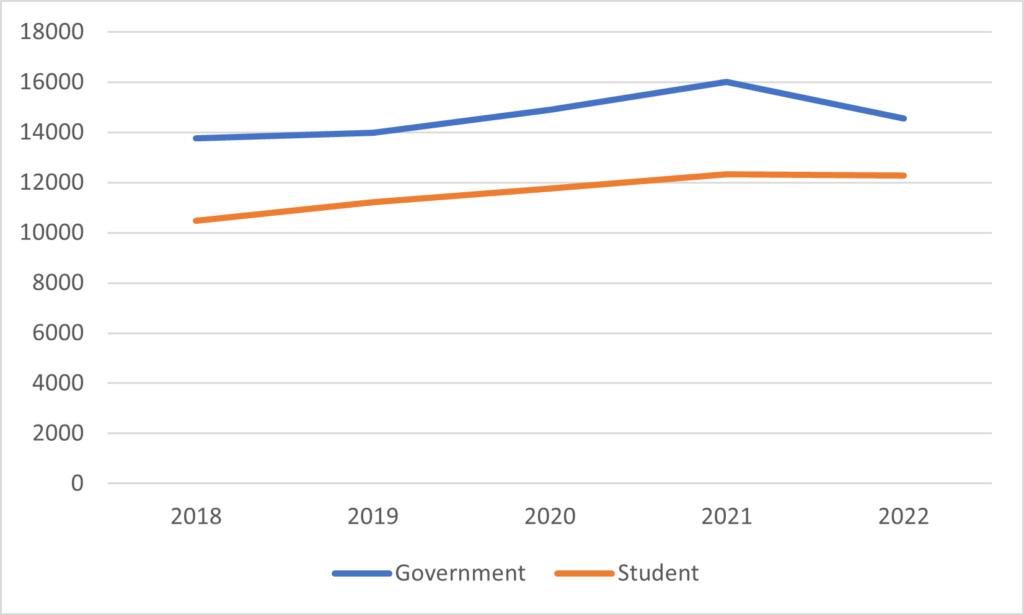

On the whole, this is good news. But I think there is real trouble ahead. Income from government fell by 9% in real terms in fiscal 2022 – partly the result of the withdrawal of emergency COVID funding and partly the result of inflation. Student income was static – a reflection of either a reluctance or an inability to increase international student numbers. The government increase is definitely not going to match inflation and given the well-known problems and delays in terms with visa issuance this year, I doubt very much that the student income will either. My guess is that after inflation we are likely to see a net decline in total income for institutions in 2022-23, and quite a significant one at that.

Figure 3: University Income by Source, in millions of real $2021

And this is a bit of a problem because while the overall numbers for the sector look good, they are pretty bi-modal. Over the past three years, the sector posted a net surplus of about $5.1 billion. But over half of that comes from just five institutions – York, Manitoba, UBC, McMaster and the inevitable University of Toronto – with the last of these accounting for a stunning 30% of the total ($1.58 billion) on its own. On the other hand, there are eight institutions which have made cumulative net losses over the past three years (St. Thomas, Lakehead, Nipissing, Guelph, Wilfrid Laurier, Brandon, Calgary and Vancouver Island University) half of whom actually posted net losses in each of the three years. And If I am counting right, St. Thomas and Nipissing both have posted net deficits for nine of the past ten years.

In any event: universities didn’t do too badly as a group in 2021-22 but there are good reasons to think that 2022-23 will be substantially worse as income sources lag inflation. This should make for some interesting collective bargaining rounds over the next few months, as labour looks to past surpluses and management to future deficits to make their respective cases. And, as ever, averages can conceal big gaps between the strongest and weakest performers. The University of Toronto is becoming substantially wealthier than its competitors through a combination of good management and ruthless use of pricing power with respect to international students. But some small and mid-size schools are looking fragile. Vigilance is still needed.

Tweet this post

Tweet this post

What do universities do with their surpluses, anyway? Pay down debt? Build endowment?

I tend to think the best move would be to endow a few existing positions, thereby getting them off the books. The salary which would pay for those (now endowed) positions could then become part of the next year’s surplus, which could create more endowed positions, and so forth.