As the price of oil continues to plummet, just a few thoughts on the financial implications for universities.

In provinces that are oil importers, the effect is likely net positive, slightly. Economic growth should be a little bit above trend, inflation will fall a bit, and those factors will make it easier for provincial governments to balance budgets this year, without turning to cuts.

In provinces that are exporters, an oil price drop will likely affect the budget in two ways. The first is through reductions in royalty payments, and the second is through a decline in general tax receipts, as a result of a generalized economic slowdown. On the flip side, as oil price decreases, so too does the Canadian dollar – which means that the price of oil in Canadian dollars actually isn’t decreasing as fast. How these play out in Canada’s three major oil-producing provinces all depends somewhat on a variety of economic factors, so here’s a quick look at various the provincial budgets’ sensitivity to oil prices, and how current prices play out.

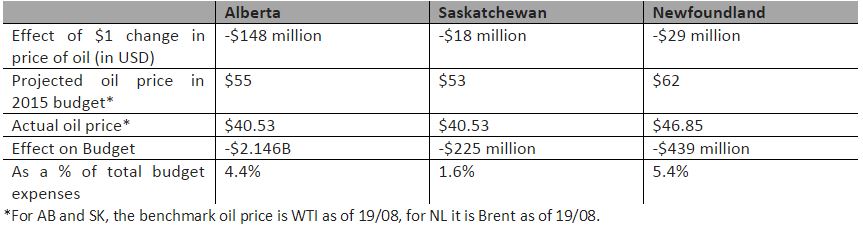

Effect of Current Oil Prices on Current (2015-6) Year Budgets, Major Canadian Oil-Producing Provinces

So, the takeaway from the table: if oil prices remain as-is for the fiscal year as a whole, the effect is equivalent to a loss of 1.6% of total expenses in Saskatchewan, 4.4% in Alberta, and 5.4% in Newfoundland. Now that’s a very rough estimate – it’s not taking account of the fact that falling oil prices are, to some degree, offset by a falling Canadian dollar (which would make the effect less severe), but it’s also not taking account of the fact that “total budget expenses” includes – in Newfoundland – quite a bit of debt payments as well, so the effect relative to program spending is understated. And in any case, what happens this year is peanuts compared to what will happen next year. This year’s provincial budgets assumed that oil would rebound to about the $80 range in 2016; at the moment, 12-month futures prices are running in the $50-55 range, so the impact of oil prices next year will be about double what you see in Table 1.

Even in Alberta, $4 billion is a lot of money. At the moment, the betting seems to be that the new NDP government is willing to do a lot of borrowing to cover the shortfall, so in the short-term this may not matter much. In Newfoundland, where the deficit is already over $1 billion, and net debt is over $10 billion, the ability to borrow may be more limited. That almost certainly means program cuts in Newfoundland; in Alberta, it will make even existing promises from the incoming government hard to meet.

What about overseas? Well, it’s worth a ponder how the drop in oil prices is going to affect higher education in the Gulf States. All of them have big social welfare bills (the price for maintaining the monarchy), but they have varying abilities to maintain this spending in the face of low oil revenues. Bahrain and Oman are already pretty close to the financial breaking-point, while the Kuwaitis and Saudis have big enough financial cushions to ride out a two-or-three year slump, but after that it gets harder to see how they will avoid significant cutbacks. Qatar looks pretty safe, come what may; within the UAE, Abu Dhabi’s cushion is much better than those of the other Emirates, including Dubai. The real worry for Canadian institutions is that there’s no guarantee that the King Abdullah Scholarship Program – which funds a large number of Saudi students in Canada – will continue to be funded at anything like current levels.

Bottom line: in this country, higher education is to no small degree dependent on the price of oil. A long-term drop in prices will affect institutions negatively. Planning and Government Relations offices take note.

Tweet this post

Tweet this post