Laurentian University will run out of cash at the end of February. That’s the most important – but far from only – take-away of the Monitor’s Report filed Monday in an Ontario court as Laurentian University filed for creditor protection.

People are throwing around words like “unprecedented” to describe what is happening at Laurentian. I’m always careful about that because before WWII a lot of wild things happened in Canadian universities (the Honorary Bursar making off with the entire University of Manitoba endowment at the height of the Depression is my favourite). And Acadia got pretty close to this position in the last decade, though it engineered a behind-the-scenes bailout and hence never had to go to face the courts in quite this way. But maybe we shouldn’t be picky: this is still a big effing deal and we should treat it as such.

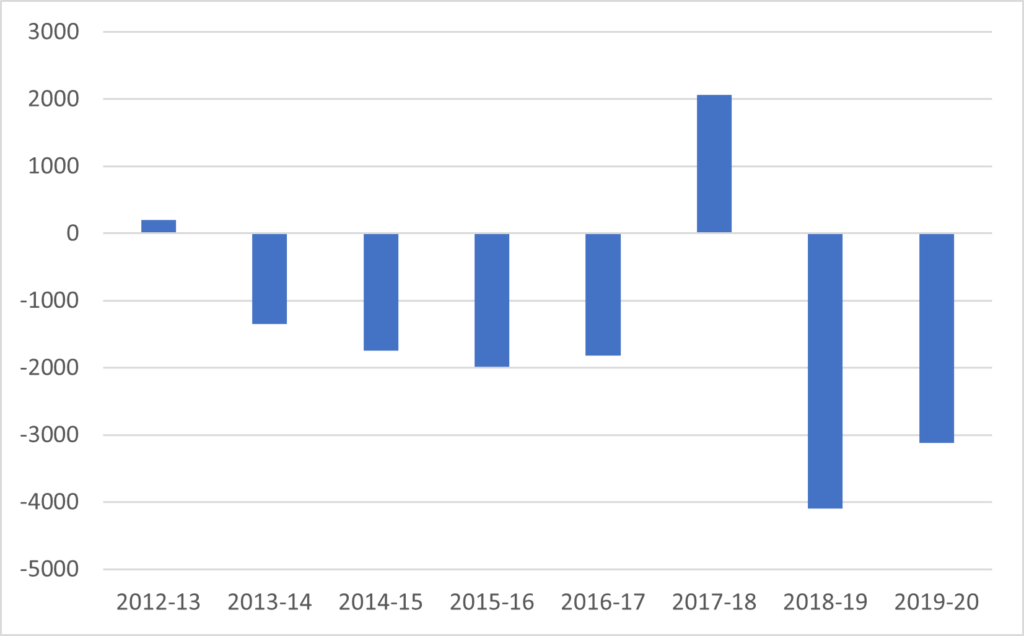

I don’t quite know where to start here because it seems to me that there is still a lot to come out on this story. That Laurentian was having persistent difficulty balancing its budgets was well-known. Figure 1 shows that in seven of the past eight years, Laurentian reported a loss. I am fairly sure no other university in Canada can say that.

Figure 1: Laurentian Net Revenue, 2012-13 to 2019-20 (in thousands)

Now if you read the filings, the Laurentian administration is making a full-throated case about how it needs to restructure, get rid of uneconomic programs, etc. – and it needs to declare financial exigency under creditor protection to do so because the faculty union has been unremittingly obstructive towards all attempts to do this in the past few years. There is a great deal of truth to this argument, and I have no doubt that Laurentian would be a better university if it could take advantage of a crisis to do all of this. But let’s be clear: the accumulated deficit over the last eight years is under $12 million. On a $200 million budget. Alone, that’s not what caused Laurentian to seek protection. There is something else going on here.

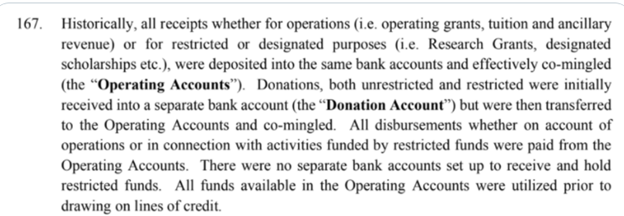

Part of that something else becomes apparent as you read through the court filing and see things like this:

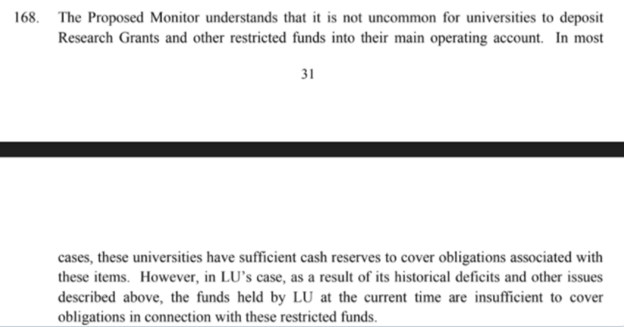

Got that? No separation between operating funds and restricted funds. Like, say, professors’ research grants, scholarships, and Retiree Health Benefit. It’s all been co-mingled. And then this:

So, this money is not just co-mingled but in fact has already been spent. In fact, as the Monitor notes, “(Laurentian) estimates the deferred contributions liability to be approximately $36.5 Million” and “while these amounts are recorded as a liability on (Laurentian’s) balance sheet, no funds have been set aside or are currently available to satisfy these obligations.” There is also something like a $20 million gap in the pension fund, though because this was valued on April 30th when equities markets were still tanked because of COVID, I’m inclined to think it is not a big deal.

Now, there’s a big gap here between $12 million in recurrent deficits and $36.5 million in now unavailable restricted funds. I have yet to see anything that explains how one situation led to another and that, I think, is the very big question that needs to be answered over the coming days. But there is yet another gap between a $35.5 million gap that at least conceivably could be bridged through a bond or borrowing and the announcement Monday that Laurentian only has $13 million in cash on hand and this will run out in the next four weeks. There is something bigger going on here that still needs an explanation beyond what we can see in the court filings. I can’t speculate on what it is: there’s just not enough public information at the moment.

(You may be scratching your head at these numbers because some of the coverage uses figures like a “$100 million debt”. Remember about $85 million of that is mortgages on construction undertaken over the last decade – most of these are deals that extend into the 2040s and aren’t costing the university more than $4-5million per year. You should ignore this part of the story and focus on the short-term debt because that’s where the story – whatever it is – is.)

But clearly something happened this summer. Both Desjardins and Royal Bank cut their lines of credit to the institution; in Desjardins’ case, an outstanding $14 million was paid in full when September tuition came in (this was not presented in the court filings as the result of a repayment-in-full demand by Desjardins, but given the context it sure reads that way). What, if anything, did the banks know that was not evident to anyone else at the time? We simply don’t know.

What we do know is that by November, the Board of Governors’ knew something was very wrong and set up a special “In Camera Ad Hoc Committee on Contingency Planning” which had “the authority to act on behalf of the Board on matters related to all initiatives to address LU’s financial challenges” – which is one hell of a broad mandate. Apparently 9 of the Board’s 25 members were involved, but we do not know which ones. And from what one can glean from the documents, they headed very quickly towards the idea of creditor protection.

The big question people are rightly asking right now is – how in the hell did this happen? Not just “how does a university with millions in restricted funds have only one bank account” (although that is important). But more: how the hell did KPMG, which has been Laurentian’s external auditor for at least ten years, miss this? How did they give Laurentian a clean bill of health on its 2020 financial statements just this fall at almost exactly the same time that the banks were pulling the plug? This seems like an area where lawyers may get involved at some point.

Unfortunately, beyond all this we’re basically in the dark about what has happened and where things go from here. And I don’t just mean you and me, reader, I mean folks in Sudbury as well. The extent of the damage and indeed anything to do with Monday’s filing was held incredibly closely within the Senior administration. In fact, apart from the President, Robert Haché and presumably the VP Finance, it’s not clear anyone knew what was going on until the moment the university hit “send” on the new release announcing it was seeking creditor protections. I’m told that Deans and some senior administrators had as little as 20 minutes notice before this came out. And since the release, it’s been radio silence from Haché and co. Apart from one fairly tone-deaf “difficult but optimistic message” on Monday there has not been a peep from the top floor of the RD Parker Building. Which, you know, given that you’ve just declared insolvency and have publicly announced you don’t have enough money to pay peoples’ salaries in March, might not be considered the world’s greatest comms strategy. I suspect this is going to get a lot uglier before it gets better, and you can expect to read a lot more from me as things unfold (starting tomorrow when I will be digging into institutional finances a bit).

But most importantly right now: thoughts and best wishes to my friends in Sudbury. It’s going to be rough but hopefully better days are ahead.

Tweet this post

Tweet this post

Thank you for these insights. I feel validated to read “how the hell did KPMG, which has been Laurentian’s external auditor for at least ten years, miss this? How did they give Laurentian a clean bill of health on its 2020 financial statements just this fall at almost exactly the same time that the banks were pulling the plug?” because this is all I can think about. Not just KPMG, but how did the Board of Governors’ finance committee not act in a decade?! I hope you keep posting articles like this and lifting the blanket off the hidden workings of this fine mess.

I would take a look at the amount of money spent on getting rid of people who didn’t fit with the groupies back in a past administration. It was like government…the new guy comes is and wants to bring his cronies with him. I can only imagine the public dollars spent on severances and bonuses. And the spinning of numbers and messaging made me dizzy. Mass exodus happened just as the dire situation became obvious.

“Not just “how does a university with millions in restricted funds have only one bank account” (although that is important). But more: how the hell did KPMG, which has been Laurentian’s external auditor for at least ten years, miss this?” –> I’d add why does the Ontario Provincial Government even permit this? It shouldn’t be just up to the auditors of individual universities to identify such systemic weakness.

British Columbia’s Quest University sought protection under the CCAA last year. Quest is, of course, a private university.

Bankruptcy protection may be unprecedented for a publicly funded university, but a private Canadian university – Quest – has recently emerged from a year of bankruptcy protection with its purchase by Primacorp Ventures (see https://www.pwc.com/ca/en/services/insolvency-assignments/quest-university-canada-ccaa.html). Because Quest is private, its financial statements are less readily available than Laurentian’s but according to scanned documents at https://fairquestions.typepad.com/files/quest-financial-statements-148-pgs.pdf its annual operating expenditures in 2019 were around $25 million, it ran a $4.5 million deficit, had $1.5 million in restricted cash, $4.6 million in demand loans, and total debt of $22.7 million. So, while it’s a significantly smaller institution than Laurentian, its financial situation was equally dire in proportion to its size. Given your post last week that showed applications increasing for large institutions and decreasing for smaller ones, I’m concerned that Laurentian and Quest may be harbingers of hard times to come for small universities and I wonder if one of the consequences might be an increase in mergers over the coming 5-10 years.

Four thoughts about Laurentian’s predicament:

1. If Laurentian’s annual reports to COFO-UO (and, in turn, CAUBO) are taken at face value, the university was capable of properly categorizing and reporting its revenue and expenses, and it did. This makes the university’s board’s and KPMG’s conduct even more puzzling, given that these reports were publicly available and easy to comprehend. Evidently RBC and Desjardins were able to make a connection between financial smoke and fire.

2. Perhaps Desjardins and RBC were following a path that bond rating agencies have been taking for at least the last decade: taking care to separate restricted and unrestricted assets. Only the latter are taken into account in determining liquidity.

3. The ministry had the COFO-UO data and the reports of Laurentian’s external auditor, whether fully accurate or not. The ministry approved the Laurentian”s Strategic Management Agreement, apparently without seriously questioning how some of the commitments in it could be paid for.

4. It is time that all the “northern, small, and rural” colleges and universities and the government get serious about mergers and consortia. (And do the same for Université de l’Ontario français and Boreal, before it’s too late.)

There are many business who are able to operate for many years with terrible profitability but strong cash flows/negative working capital. Without having done a deep dive into the financials what is the probability that the $14M loan call payment to Dejardins impacted cash flow enough to accelerate the distress?

Just from the timeline, I’d say pretty high. The question is why would Desjardins cut off credit. What did they see that the auditors didn’t? And why go to this length with an institution which is quite clearly “too big to fail” and which can count on revenues of $190M per year, pretty much rain or shine?

It could be something as simple as they are not a first position creditor and/or their risk department reviewed the loan – perhaps as a result of COVID – or adjusted their risk profile and decided it fell outside their risk framework and called the note. Looking forward to part 2 today!

I’m wondering how much this is meant in good faith, and how much it’s just an effort to declare an emergency, and avoid collegial oversight. One is reminded of the Reichstag fire, to draw an extreme analogy.

The saying, “No crisis should go to waste!” comes to mind very strongly. As a former LUFA Board member, this whole thing stinks to high heaven!

It’s also hard to ignore the misguided interest rate swap contracts LU entered in to in our fairly predictable low interest environment that are costing the institution $340,000 a month. LU Finance should have provided better advice but that’s probably difficult given “LU has experienced a number of challenges with the limited team and resources in the Finance department”.

Why are they playing in the swap market in the first place? Insanity.

Exactly. Interest rate swaps, currency swaps, commodity swaps, credit default swaps. Not a market place for Universities with precarious financials to be in.

I may have missed it, but any mention how the University and LUFA are in contract negotiations?

The filing of creditor protection comes less than a week after the union was going to file a bargaining in bad faith appeal to the Labour Board.

Also, this creditor protection, at least for the time being, stops all union grievances from being looked at. Grievances from 2015 are being looked at now.

Andrew – see pages 37 – 48 of the affidavit for all you need to know about Union and Collective Bargaining Agreements for LUFA, LUSA and CUPE.

For the last three years, I have been telling anyone who would listen and everyone else too that Ontario did not need a new French-language university. After Doug Ford took office, his office even called back once, but just once. Ontario has three university level institutions that give degrees in French (Ottawa, Glendon and Laurentian). They offer a large variety of programs: social work, nursing, engineering, education, business administration to name only a few. Ontario did and does not need a French-language university, much less one in Toronto where the proportion of francophones is lower than it is in eastern or northern Ontario. The statistics presented by those advocating for this unneeded institution where so skimpy that an elementary school child could have seen through them.

Now that that project has turned out to be a dismal failure – depending on whom you believe only 19 or 39 students have applied – and the designated president has resigned, the French-language university has become instant history. Whatever money is left of the $126 million the government budgeted for this unneeded institution should be spent to help those universities that already teach in French.

Let’s face it, bilingual education is more expensive than the unilingual kind. Library books and equipment cost more; bilingual professors need to be paid somewhat more than unilingual ones; classes will inevitably be smaller. If the government of Ontario, whatever its political stripe, has made a policy decision to provide its residents with French-language university level education, then the government will have to pay the cost for such programs.

It’s confounding to me that Laurentian U transitioned its employees to a more expensive Defined Benefit Plan from a Defined Contribution plan in 2012 when so many other organizations have been doing the reverse to cut costs. The disclosure on the Pension arrangement in the April 30, 2020 Audited financials leaves a lot to be desired. Although the plan’s assets may have increased in value since that time, the liability is calculated for accounting purposes at an uncommonly high discount rate of almost 6%. A lower and perhaps more realistic “going concern” rate of say 3 or 4% would have yielded a much higher liability calculation. But more importantly, what of the solvency deficit, and the required funding of that solvency deficit? No disclosure of that. I am wondering if the true actuarial deficit of the plan is much more than $20M, in particular the deficit done on a solvency basis.