The Parliamentary Budget Officer did everyone a solid yesterday by publishing a really helpful compilation of federal government expenditures on higher education. According to the publication, the Government of Canada in 2013-14 spent $12.3 billion on post-secondary education (not including money for apprenticeships, training programs or labour market agreements; that includes $5.1 billion for “human capital measures”, which is mostly Canada Student Loans and Tax Expenditures of various kinds, $3.5 billion for research, three-quarters of which is from the granting councils and the remainder through various departmental programs, and $3.7 billion through the Canada Social Transfer, which is a theoretically earmarked.

The graph below shows the evolution in expenditures in nominal dollar. While the growth is therefore somewhat exaggerated because of inflation, it’s interesting to note that overall, expenditures increased by a third, from $9 billion to $12 billion, between 2005-6 and 2013-14. This would have been a very good talking point for the Tories in the last election; it’s a bit of a mystery why they didn’t use it.

(In case you’re wondering what the bump in human capital formation spending is in 2009-10 and 2010-11, I’m pretty sure it’s the cost of the transitional measures relating to the end of the Millennium Scholarship Foundation).

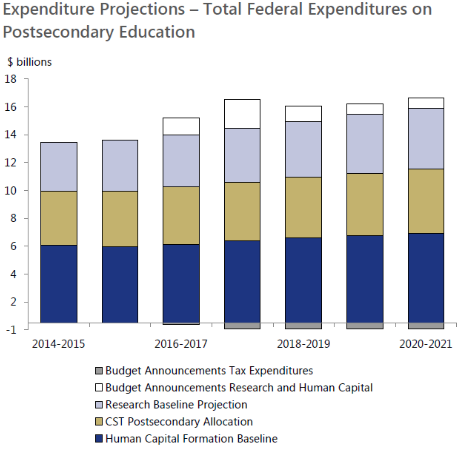

The report has a nice little projection about what future expenditures in post-secondary are going to be. The PBO seems to think there’s going to be a lot of cost growth because of an upswing in student numbers. I think that’s somewhat unlikely given the demographics; on the other hand, I think there will be cost growth as an increasing number of students figure out that they are eligible for free money under the new student aid arrangements. So it’s probably a wash. In any event, here’s what’s PBO thinks the future looks like:

The one bit of the report I find a little off is the section on who is using tax credits. The problem with analyzing the use of tax credits is that it combines parental use of tax credits with student use of tax credits. This is a problem because students are concentrated in the bottom income deciles. So if the child of a millionaire uses tax credits, it’s counted as being used by Canadians from the bottom quintile of income, which let’s be honest is a bit misleading. But still, overall, this makes a powerful point: tax expenditures are skewed to the wealthier end of society and it’s an awfully good thing that they are being phased out in order to fund poorer students.

(Remember though: the reason tax benefits are skewed to upper quintiles isn’t because they are worth more to those individuals. These are credits, not deductions. No, the reason they are skewed is because the children of parents from upper-income quartiles are that much more likely to attend higher education and especially universities. In other words, *all* spending on higher education gets distributed this way. Which is a prime reason why education should not be free – this is the way the benefits of such a move would be skewed).

Anyways, there’s nothing special or complicated about the PBO analysis. It’s just really nice to have all this stuff well documented and presented in a straightforward manner in one place. Kudos.

(Note: I will be taking a break from blogging next week. Back on May 16)

Tweet this post

Tweet this post