Over the last couple of days, we’ve looked at federal transfers to institutions. Today I want to look at federal transfers to students, which are Kind Of a Big Deal.

It seems kind of hard to imagine today, but just over twenty years ago, the feds couldn’t wait to get out of the field. In 1994, Liberal Human Resources Minister (and later U of Winnipeg President) Lloyd Axworthy tried to get a “win” on student aid by – and I know this sounds weird, but it was the mid-90s and the country was broke, delusional and frequently drunk – converting a couple of billion dollars from the EPF cash transfer payments (see Tuesday’s blog for the gory details on EPF) into an income-contingent student loan fund which could pump untold extra billions (because it was loans not grants) into institutions who would capture these extra dollars by raising tuition. Somehow this plan caught the imagination of neither students nor provinces, and the whole idea died an ignominious death a few months later when Paul Martin banjaxed EPF and created the CHST instead. So, in late 1995-early 1996 when le tout Ottawa was thinking about how to make federalism cuddlier in the wake of the nail-biting Quebec referendum, the memory of Axworthy being pelted with Kraft dinner by angry students was still pretty vivid, and it occurred to the mandarins: why not just download this stuff to the provinces? It’s not like we ever get anything but headaches from it anyway.

Well, they didn’t do that, for reasons I’ve explained elsewhere (tl;dr, the Baby Boom Echo was just about to hit PSE and the boomers became temporarily interested in the subject so there was political credit to be had in keeping it). Instead, they did the opposite, pumping cash into an expanded student loans program, new student grants (either directly through CSLP or the Millennium Scholarship Foundation), new Education Savings Grants and a vastly expanded system of tax credits

For the sake of consistency with other data in this series I’m going to use data up to 2015-16. This matters because there was quite a big change in 2016-17 when the federal Liberals decided to kill a big chunk of tax credits and re-invest part (but not yet all) of it in student grants. So, when you read the following stats keep in mind that the balance between grants and tax credits has shifted a bit in the last few years.

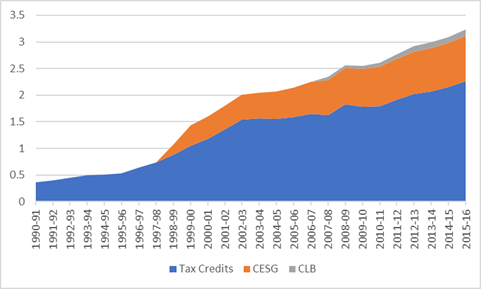

Figure 1 shows the growth in need-based loans and grants, administered either through the Canada Student Loans Program or – for the years 1999-2000 to 2008-2009 – the Canada Millennium Scholarship Foundation. Loans rose quickly in the 1990s when the federal loan limit increased by 60%. Then in 2000, with the arrival of the Millennium Scholarships, a large number of grants arrived which partially reduced the amount of loans needed. Since 2000, grants and loans have increased more or less in tandem, with between 20-22% of all federal aid – which now totals roughly $3.5 billion per year – today coming in the form of grants.

Figure 1: Federally-originated need-based Loans and Grants, 1990-91 to 2015-16, in billions of $2016

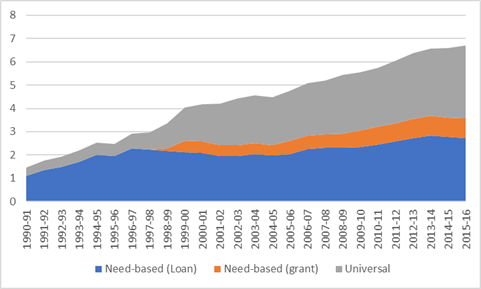

Meanwhile, in the late 1990s the Government of Canada became besotted with non-need-based aid, particularly tax credits and Education Savings Grants. These quadrupled in value from $500 million and $2 billion (in 2016 dollars) between 1996 and 2002 and then increasing in value up to $3.3 billion in 2015-16.

Figure 2: Federal Non-need-based Transfers to Individuals for PSE, 1990-91 to 2015-16, in billions of $2016

Add the previous graphs together and what you see is a truly phenomenal increase in federal outlays over 25 years. In 1990, this set of transfers was worth about $1.5 billion, of which 75% came in the form of loans. By 2015, this had risen to $6.8 billion, of which only about 35% came in the form of loans. If you’re doing the math on that, that means federal non-repayable aid (which mostly comes in the form of tax credits) increased eleven-fold over that period.

Figure 3: Transfers to Individuals for PSE, 1990-91 to 2015-16, in billions of $2016

Now, an important question here is how all of this compares to the provincial efforts in this area. And I can’t quite tell you because the data on provincial expenditures in this area technically doesn’t exist. No province discloses the value of its tax credits (though it is more or less possible to approximate their size based on federal tax data. Statistics Canada does not collect data on provincial student aid because reasons. Apart from Saskatchewan and Quebec, no province publishes its breakdown of loans and grants because other reasons (Ontario the Opaque, unlike every other province, does not even routinely publish its total student aid expenditures). Until 2011, I collected this kind of data on provinces’ behalf but since then I have not had access. There is a bit of a data problem here.

Tweet this post

Tweet this post