Back in July, the Canadian Association of University Business Officers released the results of its survey of university finances for 2013-14. The results underline the fact that institutions in Canada are facing some highly heterogeneous financial circumstances.

Let’s start with operating budgets. Though universities are allegedly facing some kind of unprecedented austerity, total operating income rose by 4.17% in real dollars from the previous year (inflation from September 2012 to September 2013 was a shade over 1%). Income from government rose 0.9% in real dollars, from $11.1 billion to $11.2 billion. But the big new source of money came from student fees, which rose 5.8% (again, after inflation) to $8.6 billion. Remember, that’s not because tuition fees rose by 5.8%, but rather because both tuition fees and enrolment (notably, international enrolment) increased.

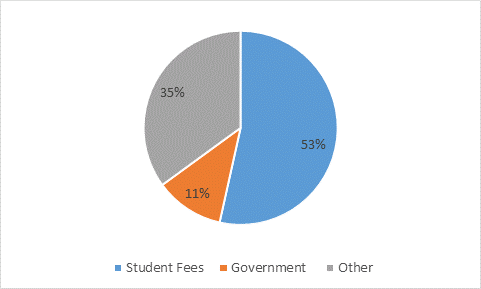

The surprise in 2013-14 was that although government grants and fees make up 91% of operating income, it was the remaining 9%, mostly endowment income, which actually accounted for 35% of all income growth, as shown below in Figure 1. That’s probably not sustainable.

Figure 1: Source of Operating Income Growth

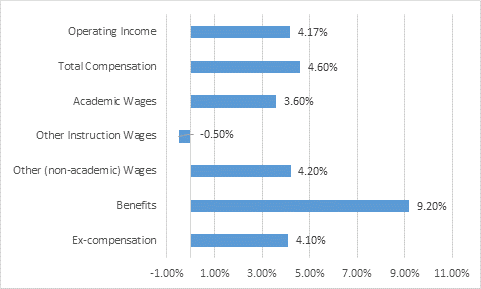

So, if operating income went up 4.17% after inflation, universities must be swimming in cash, right? Well, no. Because, in fact, spending went up to match income growth exactly at 4.17%. Figure 2 shows the year-on-year increase in real spending.

Figure 2: Increases in Real Spending

Briefly: Compensation, which forms around 75% of the operating budget, is up by 4.6% after inflation (yes, after). It’s not from hiring temps or sessionals, which gets classified as “other instructional wages” – that line item has actually shrunk slightly. Total academic wages are up 3.6%; total non-academic wages are up 4.2%. (Lest anyone get too excited about wage growth among non-academics, be aware that it’s primarily in student services and IT. The smallest registered growth among all functional sectors was central administration, at 3.2%.) But the real killer is what’s happening to benefits: up 9.2% in real terms. Regardless of why this is happening (my guess: topping up barely solvent pension plans), the technical term for this situation is “bananas”. But of course, it’s unfair to blame everything on the wage bill because universities aren’t excelling at restraining growth on their non-wage spending, either: that’s up 4.1%. All of which is to suggest that the revenue theory of expenditure is alive and well in our universities; they raise all they can, and then spend all they raise.

Now of course, these trends aren’t spread equally across universities. At some institutions, increases in operating budget came in at over 10% (UQTR, Trinity Western, and also UBC, but I think some of that is a reclassification issue). Queen’s had an 8% real rise in income, and Toronto saw a 6% increase. But at the other end of the table it’s pretty ugly. UNB and PEI saw a fall of 3% in real terms, Mount Royal 4%, and NSCAD University a whopping 12%.

Similarly, outside operating budgets, universities across the country have taken a hit. Research income fell in nominal terms for the first time since 1995-1996; capital income fell by 8%, and now sits below $1 billion in real terms for the first time since 1998-99.

So, in short: operating costs are rising much faster than government funding, leaving institutions to fill the whole with larger student numbers and lots more international students. Research and capital funding are down in some serious ways. But these trends are playing out in different ways in different parts of the country. Kind of like last year only more so.

Happy Election Day, all; don’t forget to vote!

Tweet this post

Tweet this post

I would be very hesitant to read anything into endowment income in this case:

1. Endowment income will vary widely year over year due to external market forces more than anything else.

2. Endowment income should generally not be in the operating fund as it is typically earmarked for student services including scholarships, research, facilities, etc. If there is a significant amount in the operating fund it may be due to reporting errors more than as a real source of funding..