On Friday, we looked at the evolution of average monthly student loan payments since the 1980s. Though debt has increased considerably during the past thirty years, it’s been pretty stable over the last decade. Meanwhile, a major decline in interest rates has caused student loan payments to drop from a peak of $323 per month in 2000 to $268 in 2011 at the Bachelor’s degree level (in inflation-adjusted dollars).

If student debt is up but the monthly payment burden is down, are students better off? The picture to date is incomplete. What’s needed is an appreciation for graduates’ ability to pay. Chiefly, we’d ideally examine how the proportion of a graduate’s income required to service student debt has evolved over time.

Fortunately, Statistics Canada has been surveying graduates for decades. Every five years, the National Graduates Survey looks at a class of graduate students two years after graduation, offering a portrait of graduate outcomes, including labour market transition, debt management and income.

First off, it’s worth noting that university graduates have relative success finding work. The unemployment rate for Bachelor’s degree holders aged 25 to 34 has stayed between 4% and 8% since 1980; while the rate has been slightly higher for college graduates, it has remained below 10% since the early 1990s.

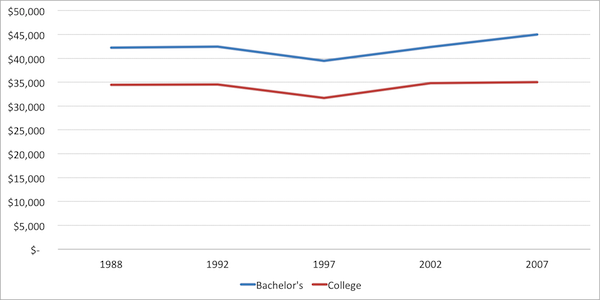

As demonstrated in Figure 1, after dipping between 1992 and 1997, graduates’ salaries peaked in 2007. Unfortunately, there is no reliable, accessible data on earnings by education level and age group since 2007.

Figure 1 – Median Gross Annual Earnings of Graduates Working Full-Time Two Years after Graduation by Year of Graduation and Level of Study, 1988-2007 (in 2007 Real Dollars)

Source: Statistics Canada’s 1986, 1990, 1995, 2000 and 2005 National Graduates Surveys

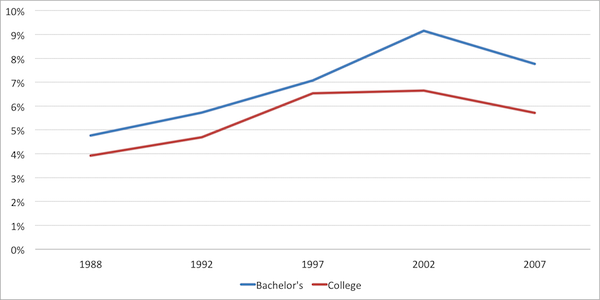

As Figure 2 demonstrates, the percentage of income spent on loan repayments increased steadily until the start of the 2000s. The class that graduated in 2000 devoted less of their monthly income to debt repayment. Unfortunately, the absence of data on graduates post-2005 means we cannot fully understand the impact of the significant reduction in interest rates since then (from 9.77% in 2000 to 5.5% in 2011).

Figure 2 – Percentage of Monthly Gross Earnings of Graduates Devoted to Student Loan Payments by Year of Graduation and Level of Study, 1988-2007 (in 2007 Real Dollars)

Source: Statistics Canada’s 1986, 1990, 1995, 2000 and 2005 National Graduates Surveys

Assuming income levels for graduates have stayed constant since 2007, the proportion of income going to debt repayment would have dropped by one percentage point between 2007 and 2009 and by another half-percentage point by 2011.

So, to conclude, student debt is unquestionably up. But low interest rates and steady graduate earnings have meant that the student debt burden hasn’t changed much in since the 1990s, and is trending downward. The Class of 2005 graduated with same debt load as the class of 2000, but spent less money out of pocket on repayment.

On the whole, the situation appears reassuring. Tomorrow, we’ll conclude by examining ways in which debt obligations might become too burdensome, and explore what policymakers are doing to prevent that from occurring.

Tweet this post

Tweet this post

Joseph: Is there any evidence that student income after graduation is plateauing along with student debt levels?

Connie,

As the chart above shows, income among graduates two years after graduation has been fairly flat (in inflation-adjusted dollars) dating back to the 1980s. Unfortunately, the only recent data that is theoretically available is from the Labour Force Survey, and comes in the form of hourly wages among individuals in a youth cohort according to their level fo educational attainment. So certainly not apples-to-apples with what’s above. Moreover, the data isn’t available via CANSIM, so while it may exist, it’s not quickly accessible. We’re looking into it, and we’ll report back. I would suspect that, even during the recession, income levels probably remained about the same ($45,000 or so for Bachelor’s-degree holders and $35,000 or so for college grads). Because interest rates have continued to fall since 2007, it’s my suspicion that the debt burden for graduates is probably a little lighter since 2007.

Tomorrow we’ll examine how programs like the Repayment Assistance Program have the tools in place to support graduates who *do* find the debt burden to be a serious challenge.