One of the challenges of trying to do large-scale global comparative higher education work is focusing. It’s a big world out there – and there are so many interesting variations and models that you just want to get your hands on everything. But at some point, you must choose a few things in order to make sense of the bigger patterns.

So it is with student financial assistance. There are aid programs in a lot of countries, many with some interesting features, but most of them are pretty trivial in terms of either providing access to students or funding to institutions. India, for instance, hands out about 2 million student loans a year, which sounds pretty impressive (and indeed, only the US system has more recipients) until you realise there are over 35 million students in India and so this only represents about 6-7% of the total student body.

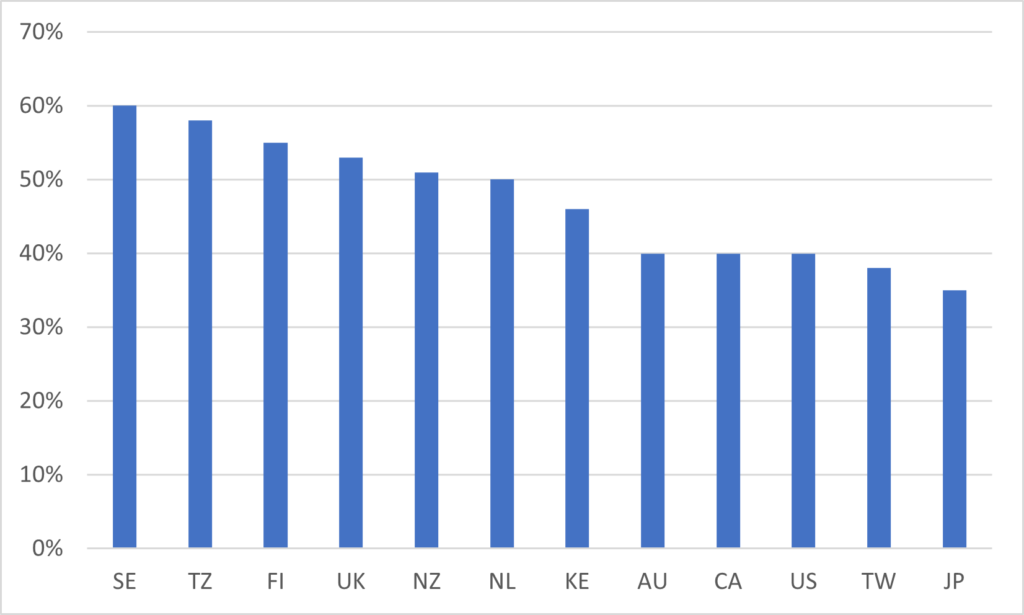

The simplest way to look at the truly significant systems is simply to look at the proportion of students they serve. And from my perspective a pretty simple dividing line can be found by the extent to which students are dependent on loans to get them through school. Among the world’s 60 largest post-secondary systems, there are, remarkably, only twelve countries in which more than a third of enrolled students (including both full-time and part-time, international and domestic) use student aid. And those twelve are, in decreasing order of take-up rate, Sweden at 60%, Tanzania, Finland, the UK, New Zealand, the Netherlands, Kenya, Australia, Canada, the US, Taiwan and Japan at 35%. No other country in the world passes the 25% mark (though for most of the past decade Chile would have qualified as well). Globally, these twelve are where all the action is.

Figure 1: Student loan recipients as a proportion of the total student population, 2018

One thing that should jump out immediately from Figure 1 is that this is a really heterogenous group of countries with utterly dissimilar higher education systems. You have two countries with zero tuition (Sweden and Finland) near the top; you also have the US and the UK where average tuition is in five figures as well as Tanzania, where tuition is highest of all, at least relative to GDP/capita (a year at the University of Dar Es Salaam costs an amount equal to about 60% of per-capita GDP, or four times what it is here in Canada). And then there are countries in the middle like Canada, New Zealand, the Netherlands and Taiwan. There are countries where private universities are the dominant form of higher education (Japan, Taiwan), places where it is not predominant but still quite common (US, Tanzania), to places where it is non-existent (Netherlands, Sweden). Overall, it’s hard to say that one type of fee-regime or ownership model causes higher levels of loan use. Different countries with different structures use loans for different policy purposes.

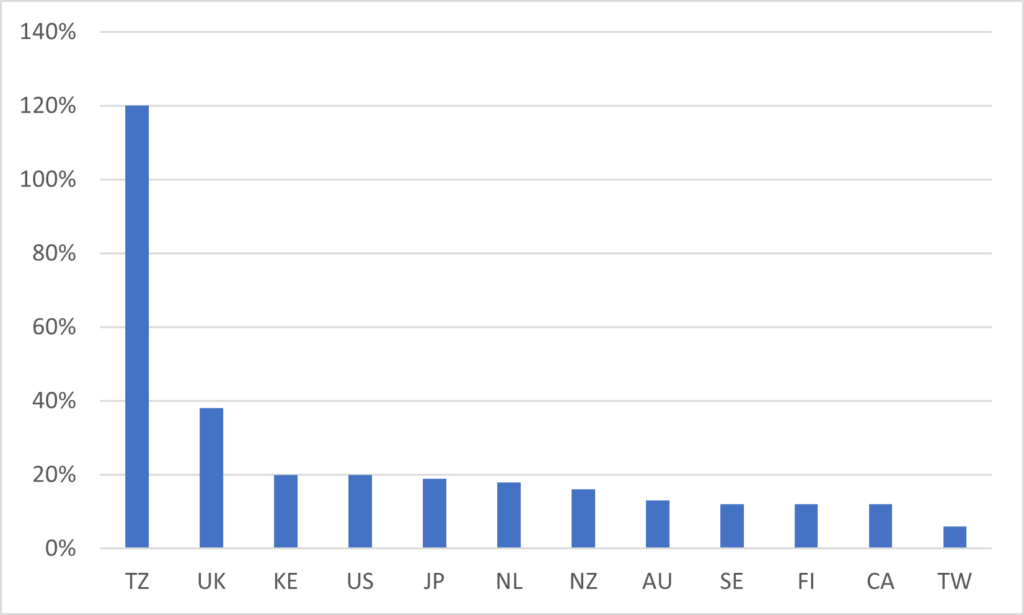

In addition to looking at how many people get loans, it’s worth looking at how much those loans are worth. In Figure 2, I standardize this across countries by dividing the average award amount by GDP per capita. In most countries, the size of the average annual award tops out at 20% of GDP/capita and is sometimes significantly lower (in Canada it is just 12%). The two outliers are the United Kingdom, where every student is eligible for a stonkingly huge loan to cover fees, and Tanzania, where the average loan is equal to over 120% of GDP (which mostly tells you that the income gap between the educated elite and the rest of the population in Tanzania is pretty large).

Figure 2: Average Annual Student Loan Disbursements per Recipient, as a Percentage of Gross Domestic Product per capita, 2018

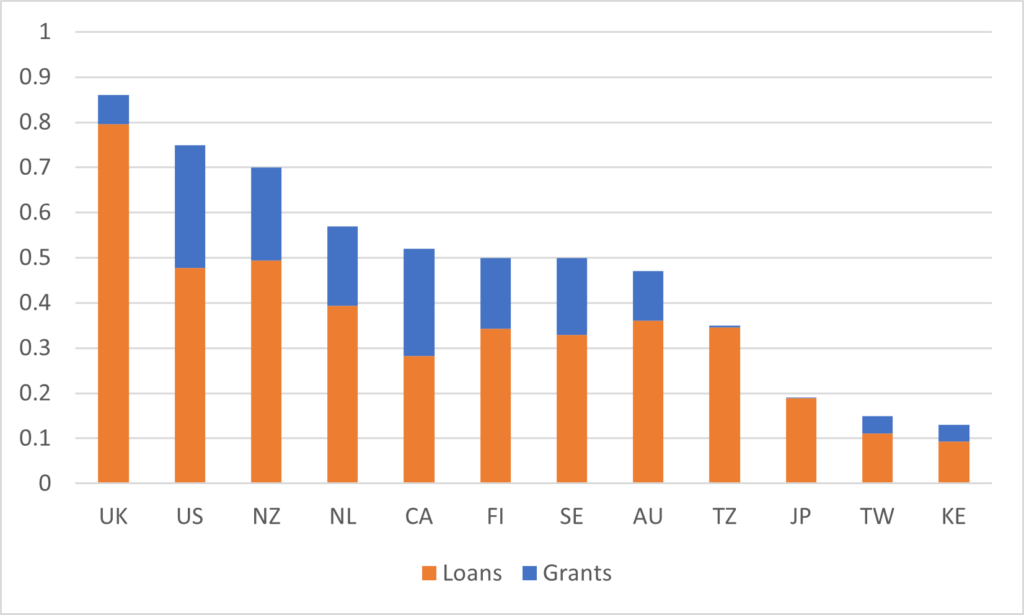

Another way in which loan programs differ is the manner in which they combine with other forms of aid. In all twelve of these countries, loans are the predominant form of student assistance. However, some countries, like Japan and Tanzania, have no grant programs to speak of, while others like Canada have a nearly 1:1 loan-to-grant mix. The mode arrangement, however, seems to be about a 70-30 split.

Figure 3: Loan-Grant split of total aid disbursement, 2018.

A final, sort of summative, way to portray this data is to look at total loans and grants disbursed as a percentage of Gross Domestic Product, which I do below in Figure 4. This in effect combines the average size of aid and the total amount of aid, and divides it by the aggregate value of each country’s output. It’s kind of cool. The UK’s high loan amounts plus huge take-up rate make it by far the number one country in the world for student aid, with annual disbursements equalling about 0.8% of annual GDP. At the other end of the scale, in Kenya loans are only worth 0.1%, mainly because even though a lot of Kenyan students get assistance, participation rates in that country are still pretty low.

Figure 4: Loan and Grant disbursement as a percentage of national GDP, 2018.

But the key point is that these countries look really different from one another, and that once again it would seem that systems that are highly loan-dependent need not follow a single pattern. Mainly loan-dependent can disburse a lot of aid or they can disburse a little. They can be loan-only systems, or they can co-exist with substantial grant programs. Just knowing there are a lot of loans doesn’t tell you very much about the system as a whole.

Thanks are due here to HESA Towers’ VP Jonathan Williams, who is even more of a data-hound than me, and whose work was the basis for today’s text. Find out more about global systems of student aid as well as many topics in our forthcoming World Higher Education Review: Institutions, Students and Finances.

One Response

Thanx for this. I gather ‘student aid’ includes aid for both tuition fees and living expenses, and that ‘students’ include domestic and international and undergraduate and postgraduate. I wonder whether there would be more homogeneity in student aid for domestic students studying first bachelor degrees.