I’ve recently been dismissive of the notion that Canada is “falling behind” in higher education since everyone seems to insist on making ludicrous comparisons with places like China, Switzerland and Singapore. But upon a little bit of further digging, it turns out there is one of our very close competitors which is doing rather well these days, one we probably should be worried about despite the fact that we’ve mostly been ignoring it since the Financial Crisis of ’08.

It’s our neighbour to the south, the United States.

Now, back in the 1990s and early 2000s, when our dollar was worth diddly-squat and the Americans were spending seriously on higher education, the USA dominated Canadian discussion about foreign competitors. It was all “brain drain” this and “impossible to keep our talent” that. We were getting creamed.

Since 2008 it’s been a different story. Everybody remembers 2009-2010, when top American talent was streaming across the border due to a combination of a strong Canadian dollar and savage cut-backs in the US. And then the Obama stimulus expired in 2011 and everyone knew that was going to put paid for research dollars. And the states were mostly bankrupt (look at what happened in Illinois!). And then Trump. Trump! Disaster, etc. The story we’ve been telling ourselves is that the American higher ed policy for last decade or so has been one long exercise in Making Canada Great Again.

The problem is, this story isn’t quite true.

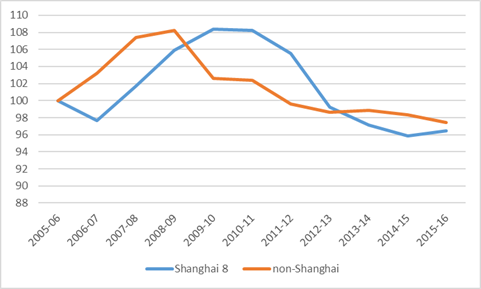

Let’s start by taking a look at what’s been going on in Canada, both at our top research universities (for the purpose of this exercise, the 8 universities that made this year’s Shanghai top 200 (Toronto, UBC, McMaster, McGill, Alberta, Montreal, Calgary and Ottawa) and at the rest of the higher education system. Figure 1 shows the change in real average total institutional per-student expenditures, indexed to 2006. What it shows is that – with some small differences in timing – both research-intensive and non-research-intensive institutions did well late last decade and worse this one, with both ending off with per-student expenditures about 3% lower than they were a decade earlier.

Figure 1: Change in Real Per-student Expenditures by sector, Shanghai top-200 ranked universities vs. rest of sector, Canadian Universities 2005-06 to 2015-16 (indexed to 2005-06)

Source: Statscan FIUC, Statscan PSIS

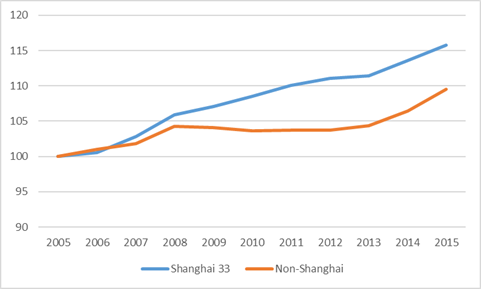

Now let’s look at similar data for private 4-year colleges in the United States. Same drill: the blue line represents the average of the 33 private universities which make the Shanghai top-200, and the orange line represented the average for the rest of the sector (about 1700 institutions in total. For both, what we see is an unbroken increase in expenditures. For many years it seemed like the big research heavyweights were leaving the rest of the sector behind, but in the last couple of years both sectors have seen a steady expansion of buying power. For the decade, the research heavyweights are up 16%, and everyone else up 10%.

Figure 2: Change in Real Per-student Expenditures by sector, Shanghai top-200 ranked universities vs. rest of sector, US Private 4-year colleges 2004-05 to 2014-15 (indexed to 2004-05)

Source: IPEDS

(if you’re wondering why my ten-year span starts and ends a year later in Canada than in the US, the answer is that it turns out – miraculously – there is one piece of data reporting that Stascan does faster and better than the Americans, and that’s reporting on financials. The 15-16 numbers just aren’t out yet in the US – sorry)

Ah, you say. But that’s the private 4-year sector – not really a fair comparison. Everyone knows those guys have loadsadough. Compare us with the public sector instead – everyone knows those guys are in deep trouble, right? Right?

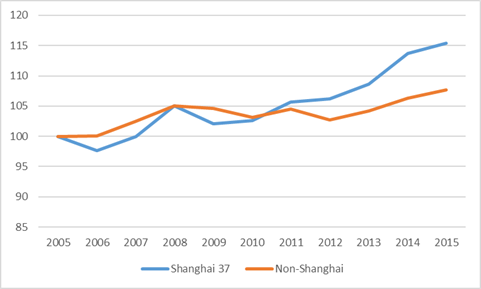

Well….not exactly. Across the big public research universities – the 37 that make the top 200 in the Shanghai rankings – expenditures are up 15% in real dollars on a decade ago, same as their counterparts in the private 4-year sector. And the rest of the sector, the poor unloved disrespected non-research-intensive universities, they are up 8% on the decade.

Figure 3: Change in Real Per-student Expenditures by sector, Shanghai top-200 ranked universities vs. rest of sector, US Public 4-year colleges 2004-05 to 2014-15 (indexed to 2004-05)

Source: IPEDS

A reasonable question here is; how did the Canadian post-secondary community just miss this? And miss it they did, because if they had this data they wouldn’t be making ludicrous claims about places like Switzerland.

The answer, I suspect, is that American universities are, from the perspective of our university leaders, are growing in the “wrong way”. This growth isn’t happening because American governments – federal and state – are plunking down vast amounts of new money. It’s because institutions are generating more money on their own – either through tuition, or self-generated income. Now it’s not that Canadian institutions aren’t doing the same (albeit on a smaller scale) – as I’ve shown elsewhere, what growth there has been in real revenues in Canadian universities over the last five years has mostly come from new fee income. But when our university lobbyists go to ask for money, it’s simpler to make the case for “investment” (i.e. spending) if the outside competition is mostly government-funded too. It’s harder to walk in and say: “we need more money so we can compete with American universities who are really good at generating their own funds through fees” because our politicians are currently allergic to that solution.

Still, the fact of the matter is, American universities are very definitely on an up-swing at a time when even most countries – including vaunted China and Switzerland – are flat or even down somewhat. This deserves more attention.

2 Responses

interesting. do expenditures include financial aid. There have been anecdotal reports from EAB that the level of “discounting” of tuition in the US has increased significantly as institutions compete to maintain enrolments. it is possible that gross income has increased but income after adjusting for scholarships and bursaries has not.

Good question. Short answer: yes, net spend not growing as quickly as gross spend, no it doesn’t come close to accounting for all of it.

(increased health insurance premiums would be another example of the same phenomenon).