Everyone talks about “rising student debt burdens” as if they are real. But they’re not. In fact, the burden of carrying a student loan has fallen significantly over the past decade.

Student loan burden is best measured by looking at the percentage of monthly after-tax income that it takes to service a loan each month. This figure will therefore be affected by four different factors, namely: the size of student loan debt, interest rates, post-graduation income, and taxes. Here’s what’s happened to each of those over the past 25 years:

1) Student debt rose very quickly in the 1990s, more than doubling between 1992 and 2000. This was because the federal government raised lending limits, and provinces by-and-large cut their grants programs. Starting in the early 2000s, however (for reasons I’ll get into tomorrow), growth in student borrowing stabilized. As a result, student debt has been roughly constant in real terms for over a decade now, as I showed back here, and may even have decreased a bit.

2) Interest rates. Nobody remembers this, but during the early 1990s, when we had the triple-whammy of the peso crisis, the sovereignty crisis, and an inflation-obsessed John Crow as Governor of the Bank of Canada, our interest rates were regularly 400 basis points higher than the Americans’. They’ve come way, way, way down. In 1991, prime briefly hit 14%, and throughout the 90s it averaged about 7.5%. Today it’s 3%.

3) Post-Graduation Income has remained remarkably constant over time. Between 1988 and 2005, it didn’t change a bit in real terms. Growth has been below inflation in the last few years because of the long recession, but it is still growing in nominal terms (we know this thanks to the many provincial graduates surveys, which have replaced the NGS as our key source of data on this subject).

4) Taxes. They’re down a fair bit. Someone with average graduate income, 2 years out of school, paid out 28% of their income in taxes in the early 90s; now they pay 22%. (Thanks to Kevin Milligan and his great CTaCS program for the help in calculating this.)

In other words, things were pretty bad in the 1990s. But since then, most of the relevant forces that underpin student loan burden have been heading in the right direction: debt is stable, or even down a bit, interest rates are down, taxes are down, and until quite recently income was more or less stable – and even now isn’t down very much. Put it all together and what you see is that the after-tax repayment burden for someone with average student wages, repaying an average-sized student loan, has fallen sharply in the last decade:

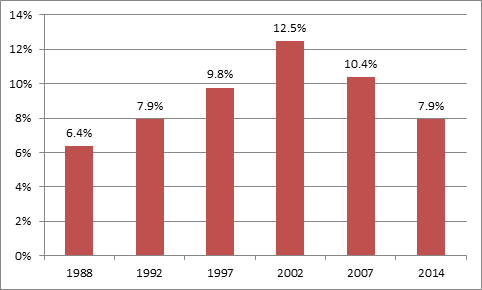

Figure 1: Percentage of Average After-tax Earnings of Graduates, 2 Years Out, Required to Service an Average Student Loan

That’s right: the burden of carrying an average loan, with an average salary, has fallen by over a third in the past decade. It’s actually back down to where it was in 1992, before the rapid rise in tuition and debt of the 1990s.

I no longer expect facts to get in the way of people trying to manufacture a good crisis, but if anyone does happen to care about the data, there you go.

Tweet this post

Tweet this post

There was no” sovereignty crisis” ,but there was an inflation-obsessed John Crow as Governor of the Bank of Canada.

see

PierreFortin presidential address in CJE November 1996 p. 766

http://econpapers.repec.org/article/cjeissued/v_3a29_3ay_3a1996_3ai_3a4_3ap_3a761-87.htm