The theory that rising tuition affects access rests on one of two premises. Either the rise in price is leaving students liquidity-constrained (that is, they don’t have enough cash on hand to meet the costs) or they have decided the investment is no longer “worth it.” If the only issue is liquidity constraint, then the problem can be solved with student loans, but since anti-tuition types rarely make that argument, one has to assume that what they believe is that students drop out or avoid PSE because they don’t think it is “worth it.”

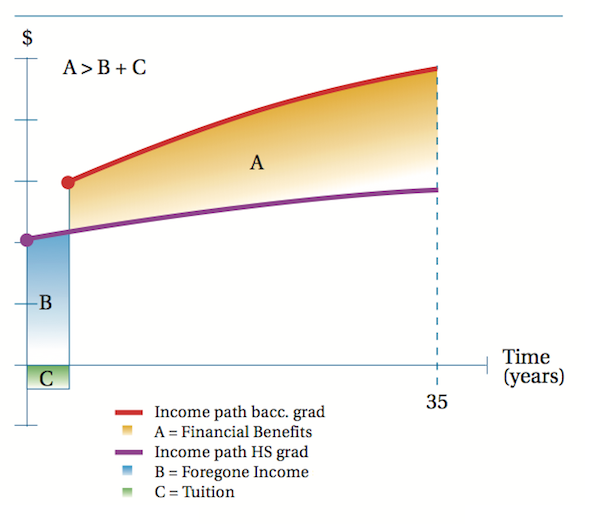

The “worth it” argument is best summed up through the handy little graph below, first sketched by Nobel prize-winning economist Gary Becker. Becker’s theory basically says that people decide on making human capital investments by comparing the short-term costs – tuition (C) plus foregone income (B) – to the long-term income benefits (A) that come with higher education. Nothing says that students have to be able to accurately measure A, B and C for this to work; just that whatever the approximations the students are using for costs and benefits, A must be larger than B plus C or a student will not attend.

Human Capital Theory makes some testable empirical predictions, such as the one that older students (who have much less time to recoup their investments) are much more likely that younger ones to respond to an increase in tuition by dropping out or choosing not to pursue higher education. This prediction was spectacularly borne out in the U.K., recently, when a tripling of tuition fees barely affected 18 year-olds, but reduced older applicants by 20% or so.

So, HCT works, right? Tuition increases, if they are significant enough, can affect enrolment. Well, yes. But look at what the theory also implies: that increases in foregone income will have the same effect as increases in tuition. Or, to put it more bluntly: a rise in minimum wage should have the same effect as a tuition increase in terms of deterring access.

This kind of makes sense. We sometimes talk wistfully about how easy it was for our parents’ generation to afford education – how they could easily earn a year’s tuition in a summer of working on the roads or in construction, or what have you. But maybe that’s one of the reasons access was so much weaker then than it is now: if wages and foregone earnings are high, what would have been the incentive to go to school?

So, just remember: if you’re anti-tuition fees because deter access, you should also be against raising the minimum wage because the effects on access are the same. Look for that message on the CFS’s next press release.

Tweet this post

Tweet this post

Hi Alex,

I think you are leaving out a point worth considering: students are not avoiding PSE because it is expensive, they are upset/frustrated because the high costs that necessitate large loans create high levels of debt. The average debt of graduating students is blooming, and job prospects for many university grads is grim. Many have to attend college for a one or two year diploma. Attendance at PSE will remain high, because society demands pushes youth to attend, no matter the cost.

The conversation really needs to focus on alleviation of debt after graduation. How easy is it for a majority of grads to pay of $30-50,000 debt? There is also the utility cost to the economy of debt repayment. The first 10-15 years a new grad spends paying of student loans, is a house, car, furniture or other items not purchased that could help boost the economy.

I haven’t read or heard much in regards to the above, if you have any studies or insight – I think that is a concern that is consistently overlooked.

Hi David. Thanks for reading our stuff.

To me, the high debt/too expensive argument is essentially the same. If a student thinks the education is a good investment, they’ll take the debt. if they don’t, they won’t.

There are actually very few students who are accumulating anything like $50,000 in debt (certainly not in Manitoba where debt is very low). Your point about the economic benefits of lower debt is one I’ll be tackling in a post in the near future, but suffice to say: there’s no such thing as a free lunch. Higher private expenditure in the future in the manner you suggest has to be bought with lower private expenditure in the present. There may be reasons to prefer consumption in the future to consumption now, but it’s not a given, I don’t think.

Hi Alex,

Greatly appreciate your blog for the insight, and morning coffee read. And the sarcasm, never forget the sarcasm!

Isn’t the question with raising the minimum wage not one of lowering access, but rather lowering attendance? There may be other incentives to choosing employment over PSE if the minimum wage is higher, but those people would technically have better “access”, right? They would have greater means.

I guess what I’m asking is: access doesn’t equal enrolment, right?]

Thanks,

Brendan

Hi Brendan. Thanks for reading our stuff (and glad you like the sarcasm).

Fair point, one could phrase it that way.

Mind you, one could also say that about a tuition fee deterrent as well. Imagine a world with high fees but essentially loans to cover tuition fees on demand (essentially the case in England). Everyone *can* go; some people choose not to because they no longer think education is “worth it”. If you are prepared to call that an access problem (and I think many people would), then you’d have to apply the same logic to this. If you’re prepared to say that’s not an access problem, then you could use the access doesn’t equal enrolment line too.