This afternoon, Quebec Finance Minister Raymond Bachand will present his budget, which will likely reiterate the province’s plan to increase tuition by $325 annually for five years, starting this fall. The tuition debate has occupied much provincial politics this early spring. Striking students are taking to the streets on a daily basis. In one indefensible incident, a CEGEP student may have lost an eye after police tossed a “stun grenade” in his direction. The anti-striketuition symbol, the carré rouge, abounds, notably at the recent French-language film awards, the Jutras. A few weeks back a group of students draped the cross that sits atop Mt. Royal in red.

Unfortunately, the discussion has produced considerably more heat than light. Nowhere is this more evident than in the fundamental misunderstanding of how tuition and student aid work.

Two concepts are key to understanding how this policy will affect students and access to higher education in Quebec.

The first is known as “sticker price” – the amount of tuition that Quebec allows institutions to charge.

The second is “net price” – the amount students have to pay out of their pockets once financial aid is factored in.

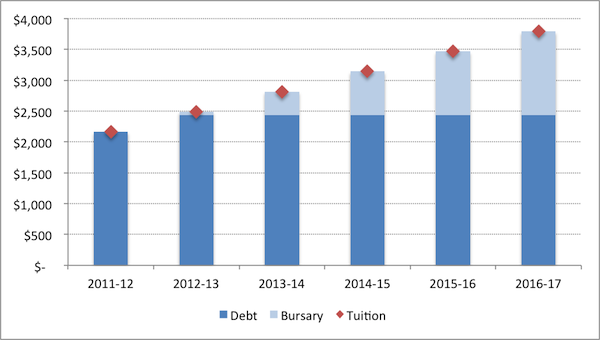

Quebec will use 35% of the new “sticker price” revenue to boost the $400 million it already spends each year on non-repayable bursaries. These bursaries are provided to one-quarter of university students largely on account of their low incomes to reduce their “net price.” The Quebec government implicitly agrees with the protestors that tuition increases can affect access for low-income students. So it’s investing 35% of new tuition revenue, to make sure that no needy student pays a penny more in net price, as illustrated in Figure 1.

Figure 1: How Low-Income Students Will Pay Tuition in Quebec, 2011-12 to 2016-17

Note: The current maximum loan is somewhat higher than tuition fees. Student aid covers a portion of both educational and living costs.

Nobody wants to pay more for their education, and nobody wants to make education inaccessible. Yet the research on access suggests that the impact of tuition increase on access is relatively weak. Moreover, those most vulnerable to a tuition increase, low-income students, are fully insulated from the pending increase.

The only real point of disagreement is whether or not Quebec should continue to subsidize middle- and upper-income students who aren’t price-sensitive at all. Students want to keep their windfall subsidy. Given Quebec’s debt-to-GDP ratio of 49%, the tuition hike represents a sensible course, turning a regressive subsidy for the wealthy into a targeted subsidy for the less well off. That Quebec can do this during a period of fiscal belt-tightening without cutting university budgets is no easy feat.

Alas, donning a red square is chic. Understanding sticker price and net price is not.

Tweet this post

Tweet this post

I was around for the student strikes of 96-98. This analysis is missing at least two things:

1) net price in this instance does not simply include sticker price (tuition) – transfers. If we’re going to talk intelligently abput the cost of university education we need to talk in terms of all-in price, which includes admin and other fees. Based on Concordia’s online fee calculator, a 1st year undergrad arts student enrolled full time (15 credits each in fall and winter, plus say 1 3-credit course in the summer, pays $2384.58 in tuition. Then add in a total of $1351.16 in compulsory fees. That’s $3735.74. Engineering and some other faculties charge extra. This is before you’ve bought a single book, found an apartment, or anything else. Admin fees are not subject to regulation; some are voted on and set by the student association while others by the administration itself. These fees are considerably higher than they were when I was in university. So it i misleading to focus on the “sticker” peice of tuition only, or to suggest the cost of a degree has been sheltered from inflation.

Second, this discussion does not take into account the fact that while, yes, the tax, aid and loan systems can be generous and do ultimately help people, each also has its flaws (including opaque bureaucracies and rules that often leave students scrambling to maintain compliance). There are outright contradictions (benefitting from non-refundable tax credits for full-time status requires you to have an income, while provincial bursary eligibility requirements can be (or at least used to be)more stringent than the university rules when it comes to full-time status, meaning there are limits as to how much you can spread out your course load in order to have time to earn money). Graduate students are treated differently than undergrads on the question of credits, course hours needed to qualify as full time. Oh and by the way, you still have to pay out of pocket and hope to hell the cheques arrive on time, because most students are rather less likely than the well monied to qualify for unsecured $30K credit limes at Prime + 1.5.

I don’t disagree with the need to balance the budget, and I don’t disagree that the PSE system, including students, ought to be a part of the solution. But I refuse to believe that cranking up tuition fees is the only workable answer.

True, the analysis doesn’t include compulsory ancillary fees (of the ~$600 or so per semester in your Concordia example, one-third is student fees/health insurance). That said, a full-on “net price” calculator would also include tax expenditures, which are significant (and, as you point out, poorly implemented – many, many students have no choice but to carry them forward or transfer them to parents). (Also, I haven’t checked in a while, but I seem to recall a wide variation in ancillary fees, with McGill and Concordia being at the top.)

There is certainly room to improve the financial aid program, beginning with an expansion of eligibility for more middel-income earners. Provinces like Alberta are simplifying rules around income clawbacks. And, yes, grad students are in a whole other basket when it comes to funding.

I’m not certain that any of this changes the fact that the approach the government has taken with regard to increasing tuition fees – to couple the increase with a major investment in financial aid for the poorest 25% – is probably the most sensible, access-positive course of action.

I think I excluded the health insurance opt-in fee, but it’s not a big one. And they do vary widely by institution and degree.

There’s a separate, but I think important and related, question we have to deal with here for the undergrad fees in particular: in today’s economy, what is the value of an undergraduate degree? I ask because my own recollections and back-of-napkin math puts the cost inflation between 1999 and 2011 of my chosen example at about 3%/year (about $2600 to $3800 for 48 credits). As has correctly noted elsewhere, the comparable figure in most other Nort American jurisdictions is much higher. And yet across North America we have exploding household debt, stagnant household incomes and rising youth unemployment at all levels (though obviously worst for those w/o a SSD. At minimum this creates a significant political, and I think moral, conundrum.

The health insurance was about $60 (not sure how many students can/do opt out, if they’re covered by their parents’ plan). Student association fees were about $150.

In a report I co-authored in 2009 (http://qspace.library.queensu.ca/bitstream/1974/5780/1/POKVol4_EN.pdf), we examined the most recent data on the value of a post-secondary education. We looked at rates of return and earnings premiums compared to non-post-secondary-educated individuals. We found that they had all been increasing since at least the 1980s. Of note, PSE earnings premium actually increased faster than PSE attainment between 1980 and 2005 (I gather there is new data that extends this trend closer to the present). So despite the fact that there are more degree-holders than ever, the value of the degree continues to increase. How much of this is the erosion of a high school diploma is a fair but, frankly, less relevant issue.

Speaking of inflation, five years from now, when tuition is $1,625 higher, it will reach levels charged in 1968. It will also be 70% of the current Canadian average (which includes Quebec).

That’s helpful to know. Clearly I need to read more of your stuff 🙂

Another thought though: if university ROI gains have mostly been achieved thru erosion of HS ROI, that’s very relevant. There’s a big difference between aspiring to a middle class income versus aspring to not be a burden on the state and society. At minimum it underscores the importance of looking at the pse financial aid model, and assessing the appropriation of risk between individual and state. In other words, a more progressive payment/funding system at the undergraduate level that suports students up-front and minimizes or eliminates accumulation of student debt at the undergrad level (but allows for greater assumption of individual risk at higher levels).

It’s worth noting that the gains to all forms of PSE have increased relative to high school – not just university. I think your model is appropriate, and it’s basically what we have in Quebec: free CEGEP, relatively cheap university that’s cheaper for low-income individuals, more expensive, but still moderately-priced graduate school. Then again, the McGill MBA situation last year shows that Quebec is reluctant to differentiate much, both among institutions and among programs. There are a lot of good reasons to see MBAs as programs that can finance themselves and other parts of the university, especially at elite schools like McGill. The government, you’ll recall, disagreed with both those ideas.

As you noted over on facebook, while the QC aid-centric model is progressive in a certain sense, it’s also complex. I’ll be more blunt: it’s inefficient, and onerous on students to the point of being objectionable. So much so that the progressiveness of the model is lost on people.