There’s been a lot of talk recently about the commodities “supercycle” coming to an end. The most immediate evidence for this is what’s happening with the price of oil, which is falling rapidly (the spot price is down 27% in the last 4 months, but more importantly the 5-year futures price is down 24% ). That’s both because of weaker global demand and because there’s a lot more oil out there than there used to be, thanks to (among other things) improved shale oil recovery techniques.

So what does this mean for higher education? At the moment it seems unlikely to affect much for universities except insofar as it affects provincial economies, and hence tax revenues. Alberta’s budget is less sensitive to oil prices than to gas prices; Newfoundland is the only province that is likely to get hit badly. On the other hand, the economies of Quebec and Ontario are likely to see a boost – oil price drops tend to act like tax cuts, so that’s good news for universities in those provinces.

Where I think the end of the commodity supercycle (if that’s what it is) is going to hurt most is in skilled trades apprenticeships. For the past decade and a half, apprenticeship registrations have been escalating constantly. And while registrations have increased everywhere across the country, a lot of it has been driven by the migration of skilled tradespeople to Alberta (and to a lesser extent BC and Saskatchewan), which in turn has been linked to the rise in commodity prices, particularly the price of oil.

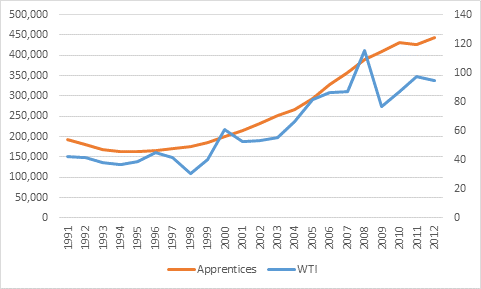

Figure 1 shows this pretty clearly. The orange line is apprenticeship registrations, and the blue line is the spot price for West Texas Intermediate crude (which is the usual benchmark for Alberta crude). It seems clear as day that the pick-up in apprenticeships in the late 1990s correlated pretty tightly with the return of the oil boom.

Figure 1: Oil Prices (in $2013 CDN) and Apprenticeship Registrations, 1991-2012

That said, it does seem as though apprentice registrations and WTI decouples somewhat after the oil price crash in 2008, so maybe they can withstand a further reduction in price. But if oil falls below $80/barrel (which it did this week), some estimates are that fully a quarter of new projects become uneconomical. Intuitively, this seems like it would have enormous knock-on effects, not just in Alberta’s resource industry but also in its construction industry. And if all those people from Ontario and the Maritimes start heading home, then the knock-on effects will be felt in the rest of the country, as well.

We got into a very lazy habit over the past decade of thinking that training and apprenticeships in the skilled trades was “safe”. We told a lot of kids that they should forego other forms of education, because they could make out like bandits as apprentices.

In the short term, that was true. But back in the 1980s, in the trough of the last commodity bust, unemployment rates in the skilled trades were in the double digits. It’s not completely out of the question that could happen again.

Tweet this post

Tweet this post

Thanks for the post. Your association between lower oil prices and lower apprenticeship enrollments makes sense.

For me, the recovery of the US economy has everything to do with its ability to produce more of its own oil. Thus the economic improvement for Ontario and Quebec is doubly linked to dropping oil prices (lower exchange rates, and increased US demand).

The Saudis are responding to increased shale oil production by increasing the supply cushion, pushing down prices. The point here is that the current oil price drop is more about market positioning than technical or geological issues, and thus the five-year futures for oil provide little insight. Perspectives on 5 year shale oil production levels vary widely, but I lean towards the perspective that the US will enjoy only a short period (i.e., < 5 years) of increased oil production.

It will be interesting to see if this is a short term dip, or something that lasts for years.